Loading

Get Standard Form 1219

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Standard Form 1219 online

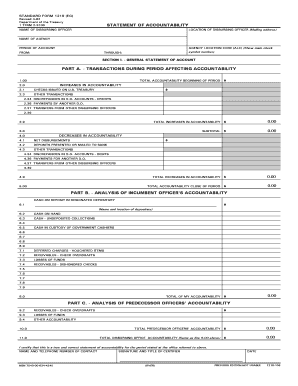

The Standard Form 1219 is a critical document used for reporting accountability within government agencies. This guide offers clear, step-by-step instructions on how to complete the form online, ensuring a smooth and accurate submission process.

Follow the steps to complete the Standard Form 1219 online.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering the name of the disbursing officer in the designated field at the top of the form.

- Provide the mailing address of the disbursing officer in the section below the name.

- Fill in the name of the agency and its corresponding agency location code (ALC). This code is typically associated with the main check symbol number for your agency.

- Indicate the period of account by specifying the start and end dates under the 'Period of Account' section.

- In Section I, begin with the 'General Statement of Account,' starting with the total accountability at the beginning of the period.

- Document any increases in accountability, including checks issued, other transactions, and any discrepancies in disbursing officer accounts. Sum these up to determine the total increases in accountability.

- Next, detail the total decreases in accountability. Include net disbursements, deposits, and discrepancies in accounts to achieve this total.

- Moving on to Section II, summarize check and deposit transactions with the U.S. Treasury as outlined in the form's respective parts.

- After completing all applicable sections, review the information for accuracy to ensure all data is correct and complete.

- Finally, save your changes, and you may download, print, or share the completed form, depending on your needs.

Complete your Standard Form 1219 online today for accurate accountability reporting.

SF 1081 – A 1081 form is used to process adjustments that affect the Dept, FY, BSN, Limit, FSN, or dollar amount. This form is used for transactions that are reported to Treasury and is necessary if the error is discovered after the transaction has been reported to Treasury.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.