Loading

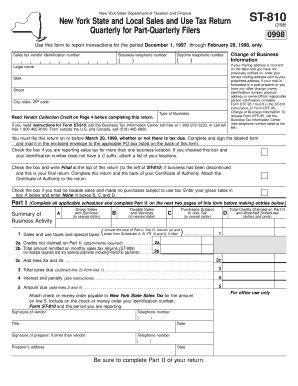

Get ( ) ( ) Change Of Business Information If Your Mailing Address Is Incorrect On The - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Change Of Business Information If Your Mailing Address Is Incorrect On The - Tax Ny online

This guide provides clear and concise instructions on how to accurately fill out the Change of Business Information form to correct your mailing address for tax purposes. Following these steps will ensure that your business information is correctly updated with the New York State Department of Taxation and Finance.

Follow the steps to fill out the form accurately.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Locate the section labeled 'Change of Business Information'. If your mailing address is incorrect, write the correct address next to your preprinted address. Be sure to double-check for accuracy.

- If any other information has changed, such as your business name, identification number, physical address, or owner/officer responsible person, you will need to complete Form DTF-95.1 or Form DTF-95 for those changes.

- Fill in your correct legal name, doing business as (DBA) name, street address, city, state, and ZIP code in the designated fields.

- Indicate your type of business by selecting the appropriate category from the list provided.

- Include your sales tax vendor identification number and both your business and daytime telephone numbers in the respective fields.

- Review all entries for completeness and accuracy before saving your changes.

- Once you have completed the form, you can download, print, or share it as needed for your records and compliance.

Ensure your business information is up-to-date by filling out and submitting your form online today.

Can I file my amended return electronically? (updated January 5, 2024) Yes. If you need to amend your Form 1040, 1040-SR, 1040-NR, or 1040-SS/PR for the current or two prior tax periods, you can amend these forms electronically using available tax software products.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.