Loading

Get 2012 538s Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 538s Tax Form online

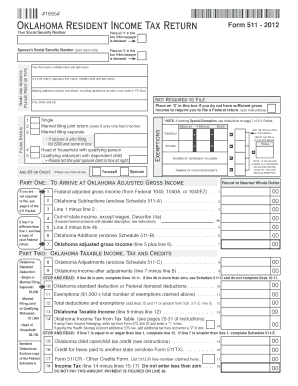

This guide provides a clear, step-by-step process for completing the 2012 538s Tax Form online. The 538s form allows individuals to claim a refund of sales tax and is essential for eligible taxpayers in Oklahoma.

Follow the steps to successfully complete your 2012 538s Tax Form.

- To begin, click the ‘Get Form’ button to obtain the 2012 538s Tax Form and open it in your preferred editor.

- Provide taxpayer information, including your name, social security number, and address. Ensure that all information is accurate and matches your identification documents.

- Indicate whether you or your spouse have a physical disability and if you are 65 years of age or older. This is necessary for determining eligibility for additional exemptions.

- List your dependents including their names, ages, social security numbers, and relationships to you. Remember that you cannot include yourself or your spouse as dependents.

- Calculate your total gross household income, including wages, social security payments, pensions, and any other sources of income as defined in the instructions.

- Determine your eligibility by following the steps outlined in Part 3 of the form. If you exceed the income limits, you will not qualify for the credit.

- Complete the sales tax credit computation section by multiplying your total qualified exemptions by the credit rate.

- Decide if you want your refund directly deposited into your bank account. Fill in your account information accurately to avoid delays.

- Sign and date the form to affirm that all included information is true and accurate. If filing jointly, your spouse must also sign.

- Upon completion, save your changes and download or print the form. Ensure that you retain a copy for your records.

Complete your 2012 538s Tax Form online today to ensure you receive your sales tax refund efficiently.

Mail. Credit Card. Electronic Funds Transfer System (EFT)/E-Check. Alternative Payment Options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.