Loading

Get Form - Cbt160-r - Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form - CBT160-R - Nj online

Filling out the Form - CBT160-R - Nj is essential for corporations to assess their estimated tax payments accurately. This guide provides a clear, step-by-step approach to help users complete the form effectively and efficiently.

Follow the steps to complete the Form - CBT160-R - Nj online

- Press the ‘Get Form’ button to access the form, ensuring it opens for you to fill in the necessary information.

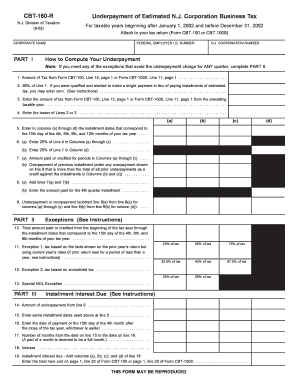

- Begin by entering the corporate name, Federal Employer I.D. Number, and New Jersey Corporation Number in the designated fields at the top of the form.

- In Part I, Line 1, insert the amount of tax from Form CBT-100, Line 15 or Form CBT-100S, Line 11. This is your starting point for computing underpayment.

- For Line 2, calculate 90% of Line 1. If eligible for a one-time payment, you may indicate zero.

- Line 3 requires the amount of tax from the previous year's return. Refer to the appropriate line in Form CBT-100 or CBT-100S.

- Line 4 asks for the lesser amount between Lines 2 and 3; ensure you calculate this correctly to avoid underpayment penalties.

- Line 5 requires you to enter the dates corresponding to the installment payments, specifically the 15th day of the 4th, 6th, 9th, and 12th months.

- On Line 6(a), input 25% of Line 4 into the appropriate columns for the first three quarters, and on Line 6(b), input 25% of Line 1 for the fourth quarter's column.

- Line 7(a) is for any amounts paid or credited for the periods listed. Complete Line 7(b) with any overpayment you intend to credit against future installments.

- Add the figures in Line 7(a) and Line 7(b) on Line 8(a), while Line 8(b) should reflect the fourth quarter installment amount paid.

- On Line 9, compute the underpayment or overpayment by subtracting line 8(a) from line 6(a) for the first three quarters and line 8(b) from line 6(b) for the fourth quarter.

- If applicable, complete Part II for exceptions by providing the total amounts paid by the specified installment dates in Lines 10 through 13.

- In Part III, if no exceptions apply, fill out Lines 14 through 19 concerning installment interest due, referencing the specific instructions.

- Finally, review your entries, ensure accuracy, and then save your changes or choose to download, print, or share the completed form.

Complete your Form - CBT160-R - Nj online today for smooth tax assessment.

The tax rate on net pro rata share of S corporation income allocated to New Jersey for non- consenting shareholders is 10.75% (. 1075). Note: The S corporation cannot make payments on behalf of consenting shareholders.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.