Loading

Get Wi Uct-101-e 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the WI UCT-101-E online

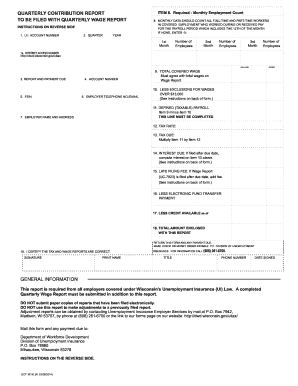

The WI UCT-101-E form is essential for employers in Wisconsin to report their quarterly unemployment contributions. This guide offers clear, step-by-step instructions to help users accurately complete the form online.

Follow the steps to complete the WI UCT-101-E form online.

- Click ‘Get Form’ button to obtain the form and open it in the digital interface.

- Locate the U.I. account number section and input your ten-digit UI account number as displayed.

- For the quarter section, select the specific quarter you are reporting for.

- Indicate the year that corresponds to the quarter selected.

- In the monthly employment count section, provide the number of full-time and part-time employees who worked or received pay during the payroll period that includes the 12th of the month for each of the three months.

- Enter your Internet Access Number, a key element for filing reports online, which is an eight-digit number provided on line 1a.

- In the total covered wage section, report the total wages paid within the quarter, ensuring this corresponds with the total wages on your Quarterly Wage Report.

- Calculate any exclusions for wages over $13,000 and list the resulting amount in the specified field.

- On the defined (taxable) payroll line, subtract the exclusions from the total covered wage and enter the amount.

- Record your tax rate and calculate the tax due by multiplying the defined payroll by the tax rate.

- If required, compute and include any interest due, and add late filing fees where applicable.

- Specify any deductions for Electronic Fund Transfers or available credits to adjust your total payment amount.

- Finally, review the total amount due and make sure to sign the form, print your name, provide your title and phone number, and enter the date signed.

Complete the WI UCT-101-E online to ensure accurate and timely reporting of your unemployment contributions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To register as an employer in Wisconsin, you need to complete the appropriate forms through the Wisconsin Department of Workforce Development. This process includes obtaining your employer identification number and understanding your unemployment tax obligations. Once registered, you'll be prepared to file your WI UCT-101-E and stay compliant with state regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.