Get Disposition Of Small Estates

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DISPOSITION OF SMALL ESTATES online

The DISPOSITION OF SMALL ESTATES form serves as a critical tool for individuals managing small estates, providing a streamlined process for estate closure. This guide will assist you in filling out the form accurately and efficiently, ensuring a clear understanding of each component and step involved.

Follow the steps to successfully complete your form online.

- Click the ‘Get Form’ button to obtain the DISPOSITION OF SMALL ESTATES form and open it in your chosen online editor.

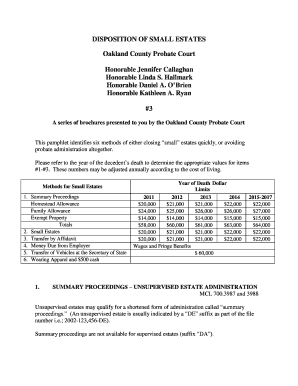

- Review the instructions on the form, which outline the criteria for determining if the estate qualifies as a small estate based on the decedent's year of death.

- Fill in the year of death and the corresponding dollar limits for the associated estate methodologies, ensuring accuracy based on the provided chart.

- Complete the required sections such as Homestead Allowance, Family Allowance, and Exempt Property, providing the necessary values that reflect the estate's assets.

- Document any relevant information that justifies the use of summary proceedings if the assets fall below specified limits.

- Once all applicable sections are completed, review the entire form for accuracy and completeness before submitting.

- Finally, save your changes, and you may choose to download, print, or share the completed form as needed.

Start filling out the DISPOSITION OF SMALL ESTATES form online to streamline your estate closure process.

What is a small estate? A small estate is an estate where the total value of the deceased's money and property is £36000 or less. A 'large estate' is an estate where the total value is above this. Small Estates - Scottish Courts scotcourts.gov.uk https://.scotcourts.gov.uk › taking-action › small-est... scotcourts.gov.uk https://.scotcourts.gov.uk › taking-action › small-est...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.