Loading

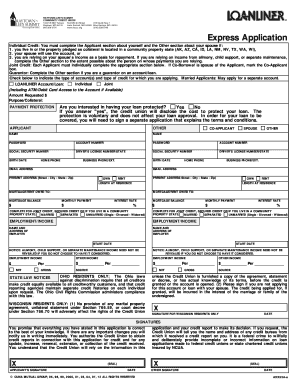

Get Credit Card Application - Quincy Credit Union

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Card Application - Quincy Credit Union online

Filling out the Credit Card Application for Quincy Credit Union online is a straightforward process. This guide provides detailed instructions to help you complete each section accurately, ensuring a smooth application experience.

Follow the steps to complete your application successfully.

- Press the ‘Get Form’ button to access the application form and open it in your preferred editing tool.

- Fill out the Applicant section with your personal information, including your name, social security number, and contact details. Be sure to provide accurate and up-to-date information.

- If applicable, complete the Other section for your spouse if you live in a community property state, they will utilize the account, or you are relying on their income. Include their personal details as required.

- Indicate whether you are applying for individual or joint credit. For joint applications, both parties must fill out their respective sections.

- Specify the type of account for which you are applying. Check the appropriate box for either Individual or Joint credit as well as the type of Loanliner account/loan.

- State the amount of credit requested and the purpose or collateral for the loan as specified in the form.

- Consider whether you would like payment protection for your loan by selecting Yes or No. Remember that this is optional and will not affect approval.

- Complete the employment and income sections for yourself and your spouse, if applicable. Provide information about employment, income sources, and any additional income.

- If you are a guarantor, complete the necessary fields in the Other section to provide your information as a guarantor.

- Review all entries for accuracy before submitting. Sign the application where indicated, ensuring all required signatures are provided.

- Once completed, save your changes, and you may download, print, or share the application form as needed.

Take the first step towards your financial goals by completing the Credit Card Application online today.

Discover it® Secured Credit Card. The Discover it® Secured Credit Card is our top pick for easiest credit card to get because it's geared toward those with limited/poor credit. It offers great rewards and charges a $0 annual fee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.