Loading

Get Irs Instruction 4797 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 4797 online

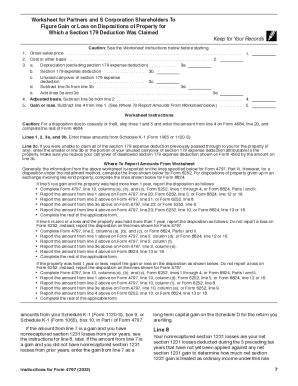

This guide provides a comprehensive walkthrough for completing the IRS Instruction 4797 online, a crucial form for reporting the sale of business property. Whether you are selling real estate, depreciable property, or dealing with recaptures, this guide will support you through each step.

Follow the steps to accurately complete the IRS Instruction 4797.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Review the purpose of the form outlined in the instructions, which details reporting requirements for sales, exchanges, and involuntary conversions of business property. Familiarize yourself with the various categories of property mentioned in the form.

- Begin filling out Part I of Form 4797, which is dedicated to the reporting of section 1231 transactions. Ensure that you accurately indicate whether the property was held for more than one year.

- Proceed to Part II, where you will report any ordinary gains and losses. This part is essential for property held for 1 year or less. Carefully enter the information based on the sales or exchanges you have conducted.

- Fill out Part III for recapture of depreciation and any additional items that must be reported as ordinary income based on the disposition of certain properties. Pay close attention to the calculations related to recapture amounts.

- Review all entered data for accuracy. It's vital to ensure that all figures are correct to avoid complications with your return.

- Once you have completed the form and reviewed it, you may choose to save changes, download, print, or share the form as needed.

Take control of your tax reporting by filling out and submitting your IRS Instruction 4797 online today.

Both Schedule D and Form 4797 are intended to acknowledge capital gains; however, that's where the similarities stop. Whereas Schedule D forms are used to report personal gains, IRS Form 4797 is used to report profits from real estate transactions centered on business use.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.