Loading

Get Irs Ct-1 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS CT-1 online

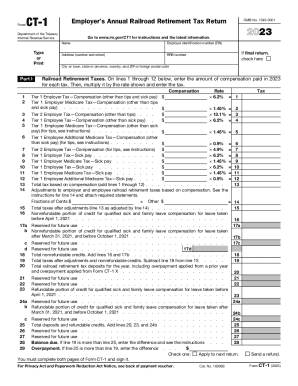

The IRS CT-1 form is crucial for reporting employer's annual railroad retirement taxes. This guide provides a clear, step-by-step approach to filling out the form online, ensuring you understand each section and field.

Follow the steps to accurately complete the IRS CT-1 form.

- Click ‘Get Form’ button to access the form and initiate the process.

- In Part I, provide your name, employer identification number (EIN), address, and railroad retirement board (RRB) number. If this is your final return, check the box accordingly.

- For lines 1 through 12, enter the total compensation paid in 2023 for each tax category. Multiply each compensation amount by the applicable tax rate to calculate the taxes owed.

- On line 13, sum all the taxes from lines 1 through 12 to get the total tax based on compensation.

- If necessary, adjust taxes based on compensation using line 14, following the instructions provided. This may require additional statements.

- Complete line 15 with the total taxes after adjustments. Then, reflect any nonrefundable credits on lines 16 and 17.

- On line 19, enter the total taxes after adjustments and nonrefundable credits. This amount represents your total railroad retirement tax liability for the year.

- If applicable, fill out Part II to provide a monthly summary of railroad retirement tax liability, detailing the liabilities for the first, second, third, and fourth quarters.

- Designate a third-party designee by providing their name and phone number if you allow someone else to discuss this return with the IRS.

- Sign and date the form, ensuring that it is completed accurately. If using a paid preparer, they must also provide their information.

- Finally, save your changes, then download, print, or share the form as needed.

Complete your IRS CT-1 form online today to ensure timely and accurate submission.

Long-term Payment Plan (Installment Agreement) Apply online: $31 setup fee. Apply by phone, mail, or in-person: $107 setup fee. Low income: Apply online, by phone, or in-person: setup fee waived. Plus accrued penalties and interest until the balance is paid in full. Payment Plans Installment Agreements - IRS irs.gov https://.irs.gov › payments › payment-plans-installm... irs.gov https://.irs.gov › payments › payment-plans-installm...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.