Loading

Get 2023 Inventory Of Taxable Property Due On Or Before ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 inventory of taxable property due on or before April 15 online

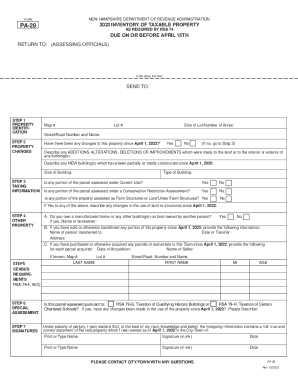

Filling out the 2023 inventory of taxable property is an essential process for property owners in New Hampshire. This guide will provide you with clear and detailed steps to complete the form accurately online, ensuring compliance with state requirements.

Follow the steps to successfully complete your form.

- Begin by selecting the ‘Get Form’ button to access the inventory of taxable property form. This will allow you to open the document in your preferred online editing tool.

- Fill in the property identification information. This includes the map number, lot number, size of the lot, and the street or road name. Ensure that you have accurate details as these are vital for property assessment.

- Indicate if there have been any changes to the property since April 1, 2022. If changes have occurred, provide a description of any additions, alterations, deletions, or improvements made to the land or buildings.

- Answer the questions regarding taxing information. Specify whether any portion of the parcel is assessed under Current Use, a Conservation Restriction Assessment, or as Farm Structures or Land Under Farm Structures. If applicable, describe any changes that pertain to these assessments since the specified date.

- Complete the section on other property. If you own a manufactured home or other building on land owned by another person, note that person’s name. Additionally, document any sales or transfers of property, providing necessary details such as the name of the new owner and the date of transfer.

- Provide the personal information of all occupants of the property as of April 1, 2023. This includes last names, first names, middle initials, and ages. If there are no occupants, indicate '0'.

- In the special assessment section, indicate if the property is assessed under RSA 79-G or RSA 79-H, and describe any related changes since April 1, 2022. Lastly, ensure that all property owners print their names and provide signatures in ink alongside the date.

- Once all sections are completed, you can save the changes, download the form, print it, or share it as needed for submission.

Complete your inventory of taxable property form online today to ensure timely submission and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.