Loading

Get Irs 1040-ss 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-SS online

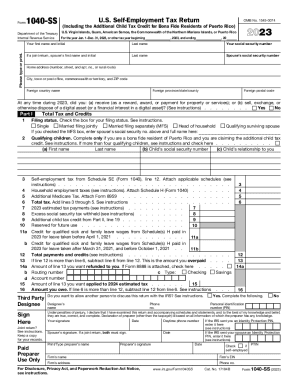

Filing your IRS 1040-SS form online can simplify the self-employment tax return process. This guide provides clear instructions on how to successfully complete each section of the form to ensure proper filing.

Follow the steps to complete your IRS 1040-SS online.

- Click ‘Get Form’ button to access the IRS 1040-SS form and open it in the editor.

- Enter your personal identification details, including your first name, last name, and social security number. If filing jointly, provide your partner’s information as well.

- Fill out your home address, ensuring it is complete with number, street, apartment number, city, and postal code.

- Indicate whether you received, sold, or otherwise disposed of any digital assets during the tax year by selecting 'Yes' or 'No.'

- Proceed to Part I, where you will select your filing status by checking the appropriate box.

- If applicable, provide details about qualifying children if you are claiming the additional child tax credit, including names and social security numbers.

- Calculate your self-employment tax based on Schedule SE and enter that amount in the indicated field. Attach any necessary schedules.

- Sum up any additional taxes, including household employment taxes and additional Medicare tax, as specified.

- Total your taxes, credits, and payments, ensuring accurate addition and completion of each relevant line.

- If you have an overpayment and want a refund, provide your banking information. If there is tax owed, ensure that the correct amount is calculated and indicated.

- Complete the signature section, sign, and date the form. If applicable, your partner should also sign if you are filing jointly.

- Review your completed form for accuracy, then save your changes, download, or print the form for your records.

Complete your IRS 1040-SS form online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

As a self-employed individual, you have to file: The T1 General Form, also called the Income Tax and Benefit Return, that Canadians use to file personal tax returns. Form T-2125, also known as the Statement of Business or Professional Activities. A separate GST/HST return if you are registered to collect GST/HST.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.