Loading

Get Pa Pa-8879p 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PA-8879P online

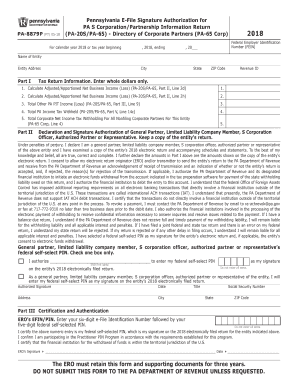

The PA PA-8879P is a vital document used for electronic signature authorization for Pennsylvania S Corporations and partnerships. This guide provides a straightforward, step-by-step approach to help users effectively complete this form online.

Follow the steps to accurately fill out the PA PA-8879P.

- Press the ‘Get Form’ button to access the PA PA-8879P document and open it in your online editor.

- Enter the calendar year for which you are filing, as well as the entity’s Federal Employer Identification Number (FEIN). Ensure accurate details are provided to avoid processing issues.

- Fill in the entity's name and complete address, including the city, state, and ZIP code. This information is essential for proper identification.

- Complete Part I by entering whole dollar amounts for the adjusted/apportioned net business income (loss), total other PA income, and total PA income tax withheld as indicated in the instructions.

- In Part II, verify the correctness of the tax return. Check the appropriate box to authorize the Electronic Return Originator (ERO) to enter your federal self-selected PIN or indicate your choice to enter it directly.

- Sign and date the form in the designated fields, including your title. Ensure your PIN is not all zeros. This step certifies your authorization and review of the return.

- Complete Part III by entering the ERO's six-digit EFIN followed by their five-digit federal self-selected PIN for certification.

- Once all sections are filled out, save the changes, download the completed form, and print or share it as necessary. Retain a copy for your records.

Complete your PA PA-8879P online accurately and efficiently today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: • You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or • You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.