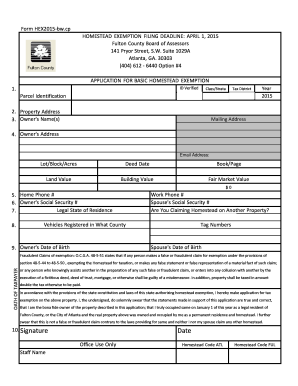

Get Ga Application For Basic Homestead Exemption - Fulton County 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA Application for Basic Homestead Exemption - Fulton County online

Filling out the GA Application for Basic Homestead Exemption is an essential step for homeowners seeking tax relief in Fulton County. This guide will provide clear and comprehensive instructions to assist you in completing the application online, ensuring that you understand each component of the form.

Follow the steps to complete your application accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identification information. You will need to provide your ID verification, the class or strata of your property, tax district, and the parcel identification number. This information helps establish the eligibility of your property for homestead exemption.

- Next, fill in the property address. Ensure this reflects the correct location of the home for which you are seeking the exemption.

- In the section for owner's name(s), provide the names of all individuals who hold ownership of the property. This must match the documentation supporting ownership.

- Complete the year field; designate the year for which you are applying for the homestead exemption, as indicated on the form.

- Provide your mailing address. This is where all correspondence regarding your application will be sent.

- Fill in your email address. This allows for efficient communication, should the need arise.

- Enter the owner’s address if different from the property address. This helps clarify residency status.

- Include your home phone number and work phone number. This ensures that the assessors can contact you easily.

- Insert your social security number and the social security number of your spouse if applicable. Be sure to confirm the legal state of residence.

- Indicate the county where the vehicles are registered. This provides additional residency information.

- Date of birth should be provided for both you and your spouse. These details are used for identification purposes.

- Answer whether you are claiming homestead on another property by selecting 'Yes' or 'No'. This is crucial for determining your eligibility.

- Fill in the tag numbers for your vehicles, if applicable. This is an additional identification measure.

- Review and sign the application in the designated signature area. By signing, you confirm that all information is accurate and you understand the legal implications of providing false information.

- Finally, specify the date of your signature. This confirms the submission date of your application.

- Once all fields are completed, you can save your changes, download the form for your records, print it out, or share it as needed.

Begin your application process online today to ensure you don't miss the homestead exemption filing deadline.

Get form

The savings from the GA Application for Basic Homestead Exemption - Fulton County can vary based on your property value and local tax rates. Many homeowners report significant reductions in their property tax bills after applying for this exemption. On average, residents can save hundreds of dollars annually, making it a worthwhile consideration for qualifying homeowners.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.