Loading

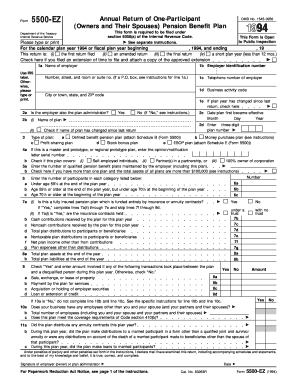

Get Form 5500-ez Annual Return Of One-participant (owners And Their Spouses) Pension Benefit Plan This

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5500-EZ Annual Return of One-Participant (Owners and Their Spouses) Pension Benefit Plan online

Filing the Form 5500-EZ is a critical step for one-participant pension benefit plans. This guide provides straightforward instructions to help you accurately complete the form online, ensuring compliance with the Internal Revenue Service requirements.

Follow the steps to complete the form easily and accurately.

- Click ‘Get Form’ button to access the form and open it in the editing interface.

- Enter the name of the employer in line 1a. If you have an IRS label, you can use it; otherwise, please type or print in this section.

- Provide the employer identification number in line 1b. This number is essential for identifying your business for tax purposes.

- Complete lines 1c and 1d with the telephone number of the employer and the business activity code, respectively.

- In line 1e, check the box if the plan year has changed since your last return. This helps keep your records up to date.

- Indicate if the employer is also the plan administrator in section 2a. Select 'Yes' or 'No' as applicable.

- Provide the date the plan first became effective in line 2c, along with the three-digit plan number in line 2d.

- Select the type of plan in section 3, indicating whether it is a defined benefit plan, money purchase plan, profit-sharing plan, stock bonus plan, or ESOP plan.

- Completing section 5 will involve checking the box if the plan covers self-employed individuals or other specified categories.

- In section 6, list the number of participants under different age categories at the end of the plan year.

- For lines related to fully insured pension plans in section 7, determine if your plan is entirely funded by insurance or annuity contracts, and complete the required information.

- Section 10 will inquire about the total number of employees. You will need to include yourself, your spouse, and partners.

- Complete the signature block, confirming the accuracy of the information provided under penalties of perjury.

- Once everything is filled out, save your changes, download the completed form, and print or share it as necessary.

Complete your Form 5500-EZ online today to ensure your pension benefit plan is compliant with IRS regulations.

Who must file form 5500-EZ? File a 5500-EZ if your Solo 401k had more than $250,000 in total assets during the previous calendar year or if last year was the final year of your plan. If you have less than $250,000 in plan assets, you don't need to file the 5500-EZ.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.