Loading

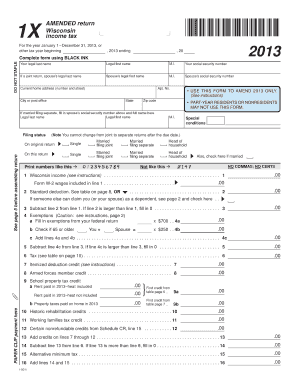

Get 2013 I-001 Form 1x, Amended Return, Wisconsin Income Tax (fillable). Amended Return Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 I-001 Form 1X, AMENDED Return, Wisconsin Income Tax (fillable)

Filing an amended return can be a straightforward process with the right guidance. This guide provides clear, step-by-step instructions on how to accurately complete the 2013 I-001 Form 1X for Wisconsin income tax purposes, ensuring you address any necessary changes with ease.

Follow the steps to successfully complete the amended return form.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill out your personal information at the top of the form, including your legal last name, first name, middle initial, and social security number. If you are filing jointly, include your spouse's information as well.

- Indicate your current home address, ensuring to complete all fields: number and street, apartment number (if applicable), city, state, and zip code.

- Select your filing status by marking the appropriate box. Ensure to check if married to verify your status correctly.

- Input your Wisconsin income in line 1. Make sure to use black ink, and avoid any commas or cents in your entries.

- Report your standard deduction on line 2 based on the guidance provided in the form instructions.

- Complete line 3 by subtracting your standard deduction from your total income. If the deduction exceeds your income, fill in '0.'

- Proceed with exemptions in line 4, adding any applicable amounts from your federal return and completing the boxes for older adults if applicable.

- Calculate your tax amount per the instructions provided in the form to fill in line 6.

- Complete the subsequent lines for any credits, including armed forces member credit, school property tax credit, and any other applicable credits up to line 39.

- Finally, review all entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Take the next step by completing your documents online today.

Amending a return is not unusual and it doesn't raise any red flags with the IRS. In fact, the IRS doesn't want you to overpay or underpay your taxes because of mistakes you make on the original return you file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.