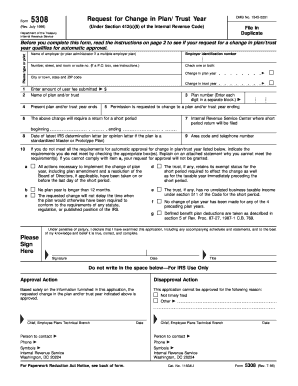

Get Form 5308 (rev. July 1998). Request For Change In Plan/trust Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5308 (Rev. July 1998). Request For Change In Plan/Trust Year online

Filling out Form 5308 allows users to request a change in the year for their employee retirement plan or trust. This guide provides clear, step-by-step instructions for successfully completing the form online, ensuring you understand each component involved in the process.

Follow the steps to fill out the Form 5308 with ease.

- Click ‘Get Form’ button to obtain the form and open it within your preferred application.

- Begin by typing or printing the name of the employer or plan administrator in the designated field. This helps identify the responsible party for the plan of trust.

- Enter the employer identification number, a unique identifier that is necessary for processing your application.

- Provide the full address (number, street, and room or suite number). If you are using a P.O. box, refer to the instructions for specific guidance.

- Indicate whether you are requesting a change in the plan year, trust year, or both by checking the appropriate boxes.

- Enter the user fee amount as required. Ensure that you include the correct amount to avoid processing delays.

- Input the name of the plan and/or trust as it is recorded.

- Specify the present plan and/or trust year end dates in the appropriate sections.

- Include the date of the latest Internal Revenue Service determination letter or opinion letter if applicable.

- Provide a contact telephone number with the area code to facilitate communication regarding your application.

- If you do not meet all requirements for automatic approval, check the boxes identifying the requirements you cannot meet and attach a statement explaining why.

- Sign the application, adding the date and your title to validate the submission.

- Once all sections are filled out, review the entire form for completeness and accuracy.

- Save your changes, download the completed form, and print copies for your records before sharing or filing as required.

Take the next step and complete your Form 5308 online today!

If there is more than one responsible party, the entity may list whichever party the entity wants the IRS to recognize as the responsible party. Additionally, entities must report any changes to the responsible party to the IRS within 60 days by using Form 8822-B, Change of Address or Responsible Party – BusinessPDF. Responsible Parties and Nominees | Internal Revenue Service irs.gov https://.irs.gov › small-businesses-self-employed › r... irs.gov https://.irs.gov › small-businesses-self-employed › r...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.