Loading

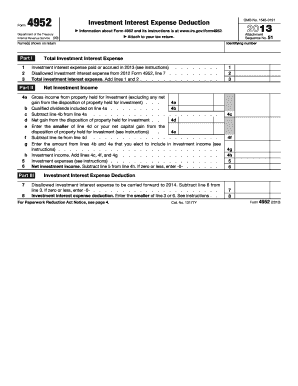

Get 2013 Form 4952. Investment Interest Expense Deduction

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Form 4952. Investment Interest Expense Deduction online

Navigating tax forms can be daunting, but understanding how to complete the 2013 Form 4952 for investment interest expense deduction will help ensure you claim the benefits you are entitled to. This guide provides clear, step-by-step instructions tailored to your needs.

Follow the steps to effectively complete your Form 4952 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Part I, input your total investment interest expense paid or accrued during the tax year on line 1. This includes interest from loans used for investment purposes.

- On line 2, report any disallowed investment interest expense carried forward from your 2012 Form 4952.

- Add lines 1 and 2 to get your total investment interest expense on line 3.

- Move to Part II, Line 4a, and enter the gross income from property held for investment. Exclude any net gain from the sale of investment property.

- On line 4b, enter the qualified dividends included in line 4a.

- Calculate the difference on line 4c by subtracting line 4b from line 4a.

- On line 4d, report any net gain from the disposition of property held for investment.

- On line 4e, enter the smaller amount between line 4d and your net capital gain.

- If applicable, elect to include any amounts from lines 4b and 4e in line 4g.

- Calculate total investment income on line 4h by adding lines 4c, 4f, and 4g.

- List any investment expenses on line 5, ensuring you exclude any deductions from passive activities.

- Calculate your net investment income on line 6 by subtracting line 5 from line 4h.

- In Part III, line 7 addresses disallowed investment interest expense to carry forward to 2014; this is the result of subtracting line 6 from line 3.

- On line 8, enter the smaller amount between line 3 and line 6 as your investment interest expense deduction.

- Once all fields are complete, you can save changes, download, print, or share the form as necessary.

Complete your 2013 Form 4952 online to ensure you maximize your investment interest expense deduction.

The Tax Cuts and Jobs Act eliminated some deductions, but advisors can still help clients save taxes. By Coryanne Hicks, Contributor April 24, 2020, at 2:29 p.m. The Tax Cuts and Jobs Act of 2017, commonly referred to as TCJA, eliminated the deductibility of financial advisor fees from 2018 through 2025.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.