Loading

Get Maryland Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MARYLAND FORM online

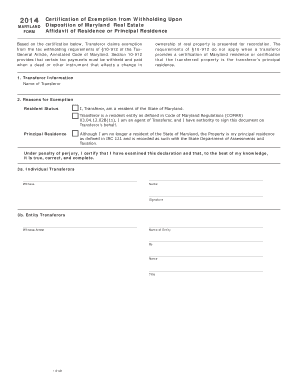

This guide provides clear and concise instructions on how to fill out the MARYLAND FORM, specifically the certification of exemption from withholding upon the disposition of Maryland real estate and affidavit of residence. Whether you are a first-time user or familiar with online document filing, these steps will assist you in completing the form accurately.

Follow the steps to complete the MARYLAND FORM with ease.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin filling out the form by entering the transferor information in the provided fields. This includes the name of the transferor.

- Indicate the reasons for exemption by selecting the appropriate resident status, confirming if the transferor is a resident of the State of Maryland, a resident entity, or acting on behalf of the transferor.

- If applicable, specify principal residence status by stating that the property is the transferor’s principal residence, even if they are no longer a resident of Maryland.

- Complete the certification section where the transferor confirms that the information provided is true, correct, and complete under penalty of perjury.

- If the transferor is an individual, provide the name and signature of a witness. If the transferor is an entity, include the name of the entity, the name and title of the individual attesting to the form.

- Review all sections for accuracy and completeness. Ensure that all required information has been provided.

- Once satisfied with the completed form, save your changes, and choose to download, print, or share the form as needed.

Complete your MARYLAND FORM online today for a seamless filing experience.

Family Investment Administration Medical Report Form 500 The information provided on this form may be used to determine eligibility for federal and State programs and participation in employment or training programs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.