Loading

Get For The Filing Year Beginning

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For The Filing Year Beginning online

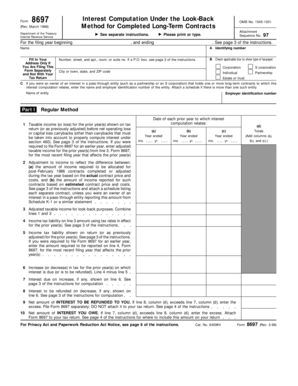

Filling out the For The Filing Year Beginning form can be straightforward when you follow a clear guide. This document assists in computing interest related to long-term contracts and ensures you meet your tax obligations accurately.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to access the form and open it for completion.

- Enter the relevant information in the fields provided: Fill in the 'For The Filing Year Beginning' section with the applicable year.

- In the 'Name' field, input your full name. If you are filing separately, include your address as directed.

- In the 'Check applicable box' section, indicate your taxpayer type by selecting the appropriate option.

- If applicable, provide the name and employer identification number of any pass-through entities you are associated with.

- Proceed to Part I where you will calculate your taxable income from prior years, along with any necessary adjustments.

- Complete lines 1 through 10 with the required financial information for interest computations, ensuring you follow the instructions closely.

- If you are filing separately, sign and date the form at the designated areas, confirming the accuracy of your information.

- Finally, review all entered details, save your changes, and either download or print the completed form for your records.

Start filling out your documents online to ensure compliance and accuracy.

There are several important dates taxpayers should keep in mind for this year's filing season: January 13: IRS Free File opens. January 17: Due date for tax year 2022 fourth quarter estimated tax payment. January 23: IRS begins 2023 tax season and starts accepting and processing individual 2022 tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.