Loading

Get Form 5735 (schedule P) (rev. October 1998). Allocation Of Income And Expenses Under Section

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5735 (Schedule P) (Rev. October 1998). Allocation of income and expenses under section online

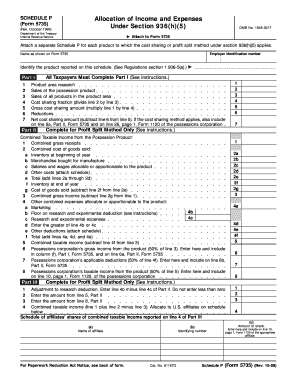

Filling out Form 5735 (Schedule P) is essential for possessions corporations reporting income and expenses under section 936(h)(5). This guide provides clear instructions to help users complete the form correctly and efficiently.

Follow the steps to successfully complete Form 5735 (Schedule P).

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your name as shown on Form 5735 and your employer identification number in the respective fields.

- Identify the product reported on this schedule by providing the relevant information in the designated field.

- Complete Part I, which must be filled out by all taxpayers. Enter details regarding product area research in line 1, sales of the possession product in line 2, and sales of all products in the product area in line 3.

- Calculate the cost sharing fraction by dividing line 2 by line 3 and record it on line 4. Then, multiply the amount in line 1 by the cost sharing fraction to find the gross cost sharing amount, which goes in line 5.

- Account for any reductions in line 6 and find the net cost sharing amount by subtracting line 6 from line 5, entering it in line 7.

- If the profit split method applies, proceed to Part II. Here, fill in combined taxable income from the possession product. Enter combined gross receipts in line 1, and the combined cost of goods sold in lines 2a to 2e.

- Continue calculating combined gross income in line 3 and other combined expenses in line 4, including marketing and experimental expenses.

- Complete the respective lines in Part III based on the applicable profit split method instructions for adjusting research deductions and the final taxable income from the product.

- If using the cost sharing method, you will need to complete Part IV, documenting the schedule of affiliates' shares of cost sharing amount and marketing intangible income.

- Review all filled sections for accuracy, then save your changes, download the completed form, print it for your records, or share it as required.

Take the next step and complete your Form 5735 (Schedule P) online to ensure accurate reporting and compliance.

A CFC's tested income for any tax year is the gross tested income of the corporation in excess of the properly allocated deductions (including taxes). A CFC with tested income for a CFC inclusion year is referred to as "a tested income CFC" (IRC § 951A(c)(2)(A); Reg.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.