Loading

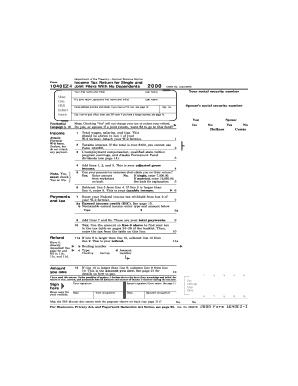

Get 1040ez-i. Income Tax Return For Single And Joint Filers With No Dependents

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1040EZ-I. Income Tax Return For Single And Joint Filers With No Dependents online

Filing your 1040EZ-I income tax return can be a straightforward process when done correctly. This guide provides clear, step-by-step instructions on filling out the form online, ensuring that you understand each component as you complete your return.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name, middle initial, last name, and social security number in the corresponding fields. If filing jointly, include your spouse’s first name, middle initial, and last name along with their social security number.

- Provide your home address, including the number and street. If applicable, include your apartment number, city, state, and ZIP code. For a foreign address, refer to the provided guidelines.

- You will see a question about contributing $3 to the presidential campaign fund. Choose 'Yes' or 'No' as appropriate.

- Report your total income, including wages, salaries, and tips. Attach your Form W-2 here, and ensure that your total taxable interest does not exceed $400.

- Calculate your tax based on your income. Use the tax table provided in the booklet to find your tax amount, and enter it in the designated field.

- If applicable, complete the lines for any earned income credit, and report any non-taxable earned income.

- If you are expecting a refund, calculate it by subtracting your total tax from your total payments. If you owe money, subtract your total payments from your total tax.

- If you wish to receive a direct deposit for any refund, fill in your banking details including routing number and account number, and specify whether it is a checking or savings account.

- Review your return for accuracy, then add your signature and the date at the bottom of the form. If filing a joint return, your spouse should also sign.

- Save your completed tax return, and choose to download, print, or share it as necessary.

Complete your 1040EZ-I income tax return online today to ensure a smooth filing experience.

The majority of Americans who earn income need to file a 1040 tax return every year. There are some exceptions, though — at least if your earnings fall under a certain threshold. Generally speaking, if you only receive Social Security income, you won't need to file a 1040 or pay income taxes on the amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.