Get Withholding On Income Effectively Connected With The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withholding On Income Effectively Connected With The online

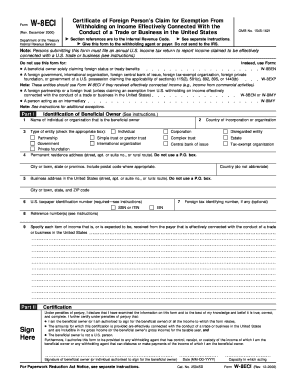

The Withholding On Income Effectively Connected With The form, officially known as the W-8ECI, serves a critical function for foreign entities engaging in business within the United States. This guide will provide you with a user-friendly approach to completing the form online, ensuring compliance and accuracy.

Follow the steps to effectively complete your form online.

- To begin, click the ‘Get Form’ button to access the W-8ECI form. This will enable you to fill it out electronically.

- In Part I, identify the beneficial owner by entering the name of the individual or organization in the designated field.

- Indicate the type of entity by checking the appropriate box — options include individual, partnership, corporation, or others as listed.

- Fill in the country of incorporation or organization, and provide the permanent residence address, ensuring no P.O. boxes are used.

- Complete the section for the business address in the United States, again avoiding P.O. boxes.

- Enter the U.S. taxpayer identification number, which is required; you may include either an SSN or ITIN.

- If applicable, provide the foreign tax identifying number. This step is optional.

- You may add reference numbers as needed in the corresponding section.

- Specify the items of income expected from the payer that are effectively connected with U.S. trade or business.

- At the bottom of the form, sign and date to certify the accuracy of the provided information, confirming that it is true and correct to the best of your knowledge.

- Once completed, you can save your changes, download, print, or share the form as necessary.

Complete and submit your W-8ECI form online to ensure your compliance with U.S. tax regulations.

What Pay is Subject to Withholding. Your regular pay, commissions and vacation pay. Reimbursements and other expense allowances paid under a non-accountable plan. Pensions, bonuses, commissions, gambling winnings and certain other income. Tax Withholding | Internal Revenue Service irs.gov https://.irs.gov › individuals › employees › tax-with... irs.gov https://.irs.gov › individuals › employees › tax-with...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.