Loading

Get Form 8865 (schedule P) (rev. December 1999)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 8865 (Schedule P) (Rev. December 1999) online

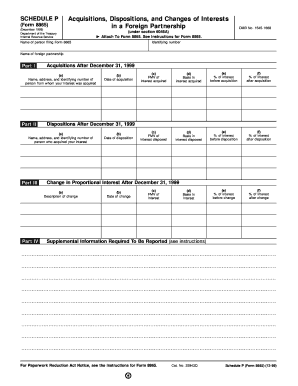

Filling out Form 8865 (Schedule P) is an essential task for individuals involved in foreign partnerships. This guide provides clear instructions on how to complete the form online, ensuring that users can navigate each section effectively.

Follow the steps to fill out Form 8865 (Schedule P) online.

- Press the 'Get Form' button to access the document and open it in your editor.

- Begin with Part I, where you need to enter the name, address, and identifying number of the person from whom your interest was acquired. Ensure that all information matches official documents.

- In Part II, state the date of disposition in field (b), and include the fair market value (FMV) of the interest disposed of in field (c). Accurately report the basis in the interest disposed of in field (d).

- Continue in Part II by providing your percentage of interest before and after the disposition in fields (e) and (f) respectively. This will help clarify your ownership stakes.

- In Part III, accurately describe any changes in your proportional interest after December 31, 1999 in field (a). Make sure to note the date of change in field (b) and the FMV of the interest in field (c).

- Record the basis in the interest in field (d) and indicate your percentage of interest before and after the change in fields (e) and (f).

- Lastly, proceed to Part IV to summarize any additional supplemental information as required. Review all entries for accuracy before proceeding.

- Once you have filled out all sections of the form, review your entries for completeness. Save your changes, and choose to download, print, or share the form as needed.

Start filling out your Form 8865 (Schedule P) online today to ensure timely and accurate reporting.

Form 8865 is filed for the foreign partnership by another Category 1 filer under the multiple Category 1 filers exception. To qualify for the constructive ownership filing exception, the indirect partner must file with its income tax return a statement entitled “Controlled Foreign Partnership Reporting.”

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.