Loading

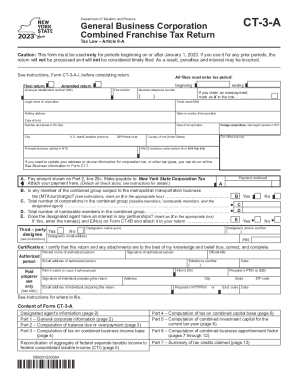

Get Form Ct-3-a General Business Corporation Combined Franchise Tax Return Tax Year 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-3-A General Business Corporation Combined Franchise Tax Return Tax Year 2023 online

Filing the Form CT-3-A is essential for corporations engaged in business in New York State. This guide provides a user-friendly approach to completing the combined franchise tax return online, ensuring that all necessary information is accurately captured.

Follow the steps to complete the Form CT-3-A online:

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the tax period’s starting and ending dates in the respective fields. Ensure that you provide the correct tax year, which for this form is 2023.

- Fill in your corporation's legal name, trade name (if applicable), mailing address, and the state or country of incorporation. Provide the care of address if necessary.

- Indicate your principal business activity in New York State and the date your foreign corporation began business in NYS if applicable.

- In Part 1, section A, mark the boxes applicable for preferential tax rates qualification, such as qualified emerging technology company or manufacturers. Fill in the total number of employees, wages, and establishments in New York State as requested.

- Proceed to Part 2 to compute any balance due or overpayment. Here you will calculate the largest tax due based on the business income, capital base, and fixed dollar minimum tax.

- In Parts 3 through 6, complete the necessary calculations for combined business income, capital base, and apportionment factor. Follow the provided instructions and ensure every entry aligns with your federal return details.

- In Part 7, summarize any tax credits claimed. Mark whether any member has been convicted of an offense and provide details for each claimed credit.

- Review all entries for accuracy and completeness before finalizing.

- Once finished, save changes, download, print, or share the completed form as needed.

Complete and submit your Form CT-3-A online today to ensure compliance and avoid potential penalties!

Form CT-3-S – Use the following address: NYS CORPORATION TAX. PO BOX 15182. ALBANY NY 12212-5182. Private delivery services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.