Loading

Get Ny Dtf Ct-3-m (formerly Ct-3m/4m) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-3-M (formerly CT-3M/4M) online

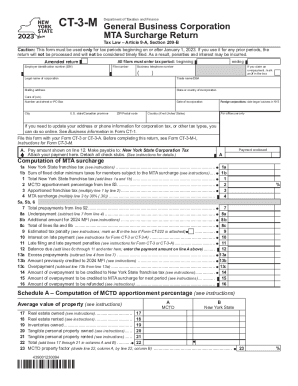

Filling out the NY DTF CT-3-M form is essential for businesses required to report their MTA surcharge. This guide provides clear, step-by-step instructions to help users navigate the form online confidently.

Follow the steps to complete your NY DTF CT-3-M form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN) and file number in the designated fields. Make sure these numbers are accurate as they are crucial for your tax records.

- Indicate the tax period by filling out the beginning and ending dates. This information is important as the form is applicable only for tax periods starting on or after January 1, 2023.

- Fill in the legal name of the corporation along with the trade name or doing business as (DBA) if different. Ensure that the names match the official records.

- Provide your mailing address, including street or P.O. Box, city, state, ZIP code, and the state or country of incorporation.

- If applicable, mark an X in the box to indicate any claim for an overpayment.

- Proceed to calculate the MTA surcharge. Enter the New York State franchise tax and the sum of fixed dollar minimum taxes in the specified lines, following the provided instructions on computations.

- Complete the computation of the MCTD apportionment percentage by referencing the guidelines for calculating property, payroll, and receipts factors specific to your corporation.

- Finalize your calculations and provide any applicable payments. Attach the payment to the form as specified.

- Review all entered information for accuracy. Save the changes, download a copy of the form, or print it for your records. Ensure that you share or submit it according to the filing instructions.

Complete your submission of the NY DTF CT-3-M form online today!

A taxpayer filing Form CT-3, CT-3-A, or CT-4 under Article 9-A, that does business, employs capital, owns or leases property, or maintains an office in the Metropolitan Commuter Transportation District (MCTD), must also file Form CT-3M/4M and pay a metropolitan transportation business tax surcharge on business done in ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.