Loading

Get Form Ct-34-sh New York S Corporation Shareholders ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-34-SH New York S Corporation Shareholders online

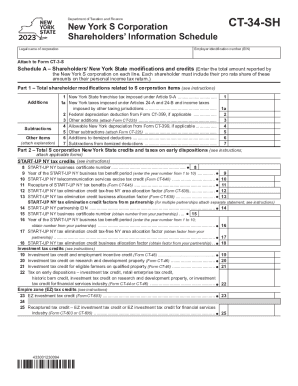

Filling out the Form CT-34-SH is essential for shareholders of New York S corporations to report modifications and credits. This guide provides clear, step-by-step instructions to assist users with the online completion of the form.

Follow the steps to effectively complete the Form CT-34-SH online.

- Use the ‘Get Form’ button to access the document and launch it in your editor.

- Enter the legal name of the corporation as specified. This is crucial for identification purposes.

- Fill in the employer identification number (EIN) accurately to ensure correct processing.

- Complete Schedule A, where you will report all New York State modifications and credits. Enter the total amounts as reported by the New York S corporation for each line item.

- In Part 1 of Schedule A, provide the total shareholder modifications related to S corporation items, including franchise taxes and deductions.

- Proceed to Part 2 of Schedule A to report S corporation New York State credits and any applicable taxes on early dispositions.

- Make sure to attach any required forms as indicated, especially for specific tax credits or recaptures.

- Move on to Schedule B to input shareholders’ identifying information. Enter their last name, first name, middle initial, as well as other required identification details.

- Review all entries meticulously to ensure accuracy before saving your changes.

- Finally, after verifying all details, download, print, or share the completed form as necessary.

Start completing your forms online today for a streamlined filing experience.

With an S corp designation, business owners have less-strict tax and tax filing obligations than those businesses using the C corporation status designation. This means that businesses that elect S corporation status aren't responsible for quarterly taxes and aren't subject to corporate income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.