Loading

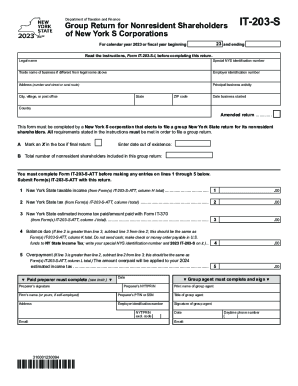

Get Ny It-203-s 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-S online

This guide provides clear and comprehensive instructions on filling out the NY IT-203-S online. It is designed to assist users, including those with limited legal experience, in accurately completing the form for nonresident shareholders of New York S corporations.

Follow the steps to successfully complete the NY IT-203-S form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the legal name of the business and any trade name, if applicable. Ensure you include the special NYS identification number and the employer identification number.

- Complete the sections for the paid preparer and group agent, ensuring that all required signatures are provided and necessary information is filled out.

- Once all fields are filled, review for accuracy before saving changes, downloading, printing, or sharing the form.

Complete your NY IT-203-S document online today to ensure a smooth filing process.

Related links form

New York Resident, Nonresident, and Part-Year Resident Itemized Deductions. Used by nonresident and part-year resident (Form IT-203) filers who need to report other New York State or New York City taxes, and tax credits other than those reported directly on Form IT-203.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.