Loading

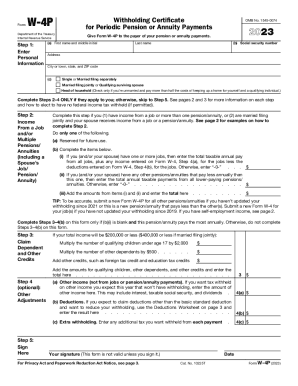

Get About Form W-4p, Withholding Certificate For Periodic Pension Or2022 Form W-4p - Welcome To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the About Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments online

This guide provides a step-by-step approach to completing the About Form W-4P, allowing users to efficiently fill out the Withholding Certificate for Periodic Pension or Annuity Payments. Whether you are new to tax forms or simply need a refresher, this guide will clarify each section and ensure your submissions are accurate.

Follow the steps to complete Form W-4P effectively.

- Click ‘Get Form’ button to obtain the form and open it in the designated online editor.

- Enter your personal information in Step 1. Fill in your first name, middle initial, last name, and social security number, along with your mailing address and the appropriate city or town, state, and ZIP code. Select your filing status by checking the correct box: Single or married filing separately, married filing jointly or qualifying surviving spouse, or head of household, if applicable.

- Complete Step 2 if you have income from a job or multiple pensions/annuities. If so, enter the total taxable annual pay from all jobs. For example, include any income noted in Form W-4, Step 4(a), minus deductions from Step 4(b). If applicable, also enter the total annual taxable payments from any lower-paying pensions or annuities. Finally, add these amounts together and enter the total.

- In Step 3, claim any dependent and other credits if your total income will be $200,000 or less (or $400,000 if married filing jointly). For each qualifying child under age 17, multiply by $2,000, and for other dependents, multiply by $500. Add any additional credits you may have, such as education tax credits, to determine your total.

- Step 4 is optional. Here you may enter other adjustments. In Step 4(a), include total anticipated other income if applicable. Use Step 4(b) to report any deductions besides the standard deduction if you want to lower your withholding. Finally, Step 4(c) allows you to specify any additional tax you want withheld from your each payment.

- Complete the form by signing it in Step 5. Remember that your form is invalid without a signature. Ensure all information is accurate before submitting.

Complete your Form W-4P online today to ensure accurate withholding for your pension or annuity payments.

In 2023 the Internal Revenue Service (IRS) revised its pensions and annuity withholding certificate, Form W-4P, to reflect new withholding rules.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.