Loading

Get Ir1314b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir1314b online

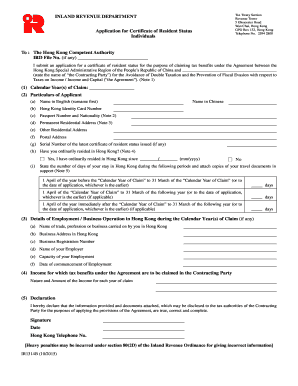

The Ir1314b is an important form used to apply for a certificate of resident status, allowing individuals to claim tax benefits under specific agreements. This guide will provide you with clear, step-by-step instructions on how to successfully fill out this form online.

Follow the steps to accurately complete your application for certificate of resident status

- Press the ‘Get Form’ button to access the Ir1314b document in your online editor.

- Fill in your IRD File Number if applicable, and state the name of the Contracting Party relevant to your tax benefits under the Agreement.

- Indicate the calendar year or years for which you are making the claim.

- Provide your personal details including your name in English and Chinese, Hong Kong Identity Card Number, Passport Number and Nationality, and your permanent residential address as well as any other residential addresses.

- Answer the question regarding your ordinary residence status in Hong Kong, and specify the date you began residing there if applicable.

- Complete the section regarding your stay in Hong Kong by providing the number of days you stayed during specified periods, and ensure to attach the necessary travel documents as proof.

- If applicable, fill out the details of your employment or business in Hong Kong, including trade name, business address, registration number, employer name, job capacity, and start date of employment.

- Specify the nature and amount of income for which you are claiming tax benefits under the Agreement.

- Review the declaration section and ensure all provided information is accurate before signing and dating the form.

- Once you have completed all sections, save your changes, download a copy of the form, and proceed to print or share as needed.

Complete your application for certificate of resident status online to take advantage of potential tax benefits.

The Certificate of Tax Residency is a legal document issued by the tax bureau stating that the foreign company/employee is in tax compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.