Loading

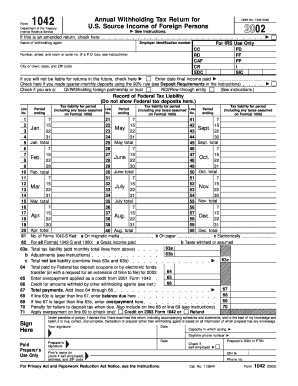

Get Form 1042 Department Of The Treasury Internal Revenue Service Annual Withholding Tax Return For U

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1042 Department Of The Treasury Internal Revenue Service Annual Withholding Tax Return For U online

Completing Form 1042 is essential for reporting tax withheld on U.S. source income of foreign persons. This guide offers clear, step-by-step instructions to help you successfully fill out the form online.

Follow the steps to complete your Form 1042 accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the withholding agent's name at the top of the form, followed by your employer identification number (EIN). Make sure to check the box if this is an amended return.

- Provide your address details including the number, street, and suite or room number. If you use a P.O. box, ensure that’s indicated as per the instructions.

- Select if you will not be liable for future returns by checking the appropriate box and enter the date of final income paid.

- Indicate if you made quarter-monthly deposits using the 90% rule by checking the appropriate box.

- Fill in the Record of Federal Tax Liability section, detailing your tax liabilities for the applicable periods.

- Enter the number of Forms 1042-S filed and the gross income paid. Follow the instructions provided in the form.

- Calculate your total tax liability and any adjustments. Enter these amounts in the corresponding fields.

- Sign and date the form at the designated areas. Ensure all information is accurate before submitting.

- After completing the form, you can save your changes, download, print, or share the document as needed.

Get started on completing your Form 1042 online today!

Related links form

Every withholding agent or intermediary who receives, controls, has custody of, disposes of, or pays a withholdable payment (to which chapter 4 withholding applies) or an amount subject to withholding, must file an annual return for the preceding calendar year on Form 1042 unless an exception to filing applies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.