Loading

Get St 556 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 556 Form online

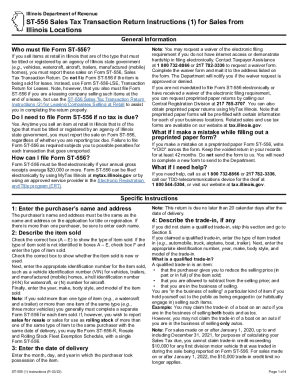

This guide provides clear and comprehensive instructions for completing the St 556 Form online. It is essential for anyone selling items in Illinois that require state government titling or registration, ensuring compliance with tax requirements.

Follow the steps to complete the St 556 Form online.

- Click ‘Get Form’ button to obtain the St 556 Form and open it for online editing.

- Enter the purchaser's name and address, ensuring it matches the application for title or registration. If there are multiple purchasers, include each name.

- Describe the item sold by checking the appropriate box (A – E) for the type of item. If it’s not listed, check box F and specify. Indicate if the item is new or used, then provide the identification number (like VIN or HIN), and enter the year, make, body style, and model.

- Input the date of delivery by entering the month, day, and year when the purchaser took possession of the item.

- If applicable, describe any trade-in items by entering their type and relevant identification information. Include any specifics regarding trade-in qualifications.

- If the sale is exempt, indicate the relevant checkbox (A – F) based on exemption criteria. Follow with the necessary documentation required for each exemption type.

- Enter the price of the item sold along with any additional costs including accessories, taxes, and fees. Round to the nearest dollar as needed.

- Determine and calculate any applicable taxes based on the amount entered. Consider location-specific tax rates if necessary.

- Complete any final adjustments, including entering any applicable credits or corrections.

- Sign the return, ensuring both the seller and all purchasers provide their signatures where required.

- Review the completed form and save changes, download the document, or prepare to print it for submission.

Complete your St 556 Form online today to ensure accurate sales reporting.

You should file Form ST-6, Claim for Sales and Use Tax Overpayment/Request for Action on a Credit Memorandum, if you are a registered retailer who has • a sales and use tax overpayment on file and you want to - convert this overpayment to a credit memorandum, or - convert it to a credit memorandum and transfer ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.