Loading

Get 866 439 8602

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 866 439 8602 online

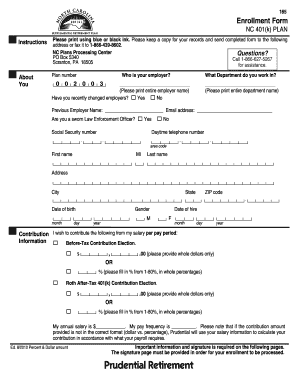

The 866 439 8602 form is an essential enrollment document for the NC 401(k) Plan. This guide provides a straightforward, step-by-step approach to completing the form online, ensuring that all necessary information is accurately reported.

Follow the steps to successfully fill out the enrollment form.

- Press the ‘Get Form’ button to access the enrollment form online and open it in your document handling platform.

- Begin by entering your personal details, including your first name, middle initial, and last name. Ensure this is spelled correctly, as it will be important for record-keeping.

- Fill in your Social Security number, which is crucial for identification purposes. Be sure to carefully enter it without errors.

- Next, provide your daytime telephone number and email address to allow for communication regarding your enrollment.

- Indicate your employer's name and department by printing the full name clearly, avoiding any abbreviations.

- Answer the question regarding whether you have recently changed employers and provide the name of your previous employer if applicable.

- Complete the date of birth, ensuring that you enter the month, day, and year accurately.

- Fill out the contribution information by selecting the amount you wish to contribute from your salary. You can choose either a dollar amount or a percentage; note that Prudential will need this in whole numbers only.

- Designate your investment allocation by completing either Part I, II, or III. Be sure to focus on one section only to avoid confusion.

- For the beneficiary section, name your primary and secondary beneficiaries and indicate the percentage for each. The total must equal 100%.

- Finally, review all of your entries for accuracy before signing the form. Your signature is required, and you must also include the date.

- Once the form is completed, you can save changes, download, print, or share the document as needed. Ensure that you keep a copy for your records.

Complete your documents online today to ensure a smooth enrollment process.

5 After you die, any unused funds will pass to those you name as beneficiaries. If you do not name a beneficiary or the account's beneficiary is deceased, the account will become part of your estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.