Loading

Get Form M-1310 Statement Of Person Claiming Refund Due A ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

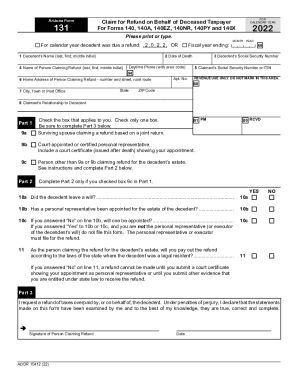

How to fill out the Form M-1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer online

Filing a claim for a refund on behalf of a deceased taxpayer can be a complex task. This guide provides a step-by-step approach to assist you in completing the Form M-1310 online, ensuring that your submission is accurate and complete.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the decedent’s name in the first field, including the last name, first name, and middle initial. This information is crucial and should match the decedent’s legal documents.

- Provide the date of death in the specified format. This ensures that the claim aligns with the appropriate tax year.

- Input the name of the person claiming the refund, including their last name, first name, and middle initial.

- Fill in the daytime phone number, ensuring to include the area code. This allows for easy communication if additional information is required.

- Complete the home address of the person claiming the refund, including the street number, rural route, city, state, and ZIP code.

- Provide the decedent’s social security number to verify identity and eligibility for a refund.

- Enter the claimant’s social security number or Individual Taxpayer Identification Number (ITIN).

- Indicate the relationship to the decedent by checking the appropriate box. Make sure to select only one option.

- If applicable, complete Part 2 based on your relationship to the decedent and any necessary appointments.

- Sign the form, affirming that all provided information is true and correct, and enter the date of signing.

- After completing the form, save your changes. You can then download, print, or share the completed form as required.

Complete your Form M-1310 online today to ensure a timely refund for the decedent.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

After the death of an individual, it is the function of his personal representative, executor or administrator to obtain refunds for his estate or to protect his estate by the abatement of taxes illegally assessed against the decedent, either before or after his death.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.