Loading

Get Closing Documents & Forms - Pa Business One-stop Shop

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Closing Documents & Forms - PA Business One-Stop Shop online

This guide provides comprehensive instructions for completing the Closing Documents & Forms required by the Pennsylvania Business One-Stop Shop. By following these steps, users can efficiently manage their online submissions, ensuring all necessary information is accurately provided.

Follow the steps to fill out the closing documents and forms correctly.

- Press the ‘Get Form’ button to access the form, ensuring it opens in the designated editor for completion.

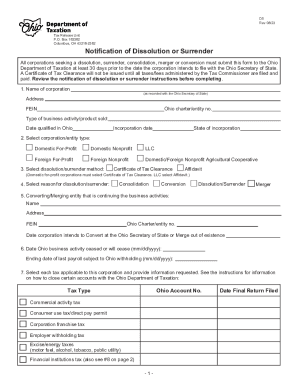

- Begin with section one by entering the name of the corporation as recorded with the Ohio Secretary of State, along with the corporation's address, FEIN, Ohio charter/entity number, type of business activity/product sold, date qualified in Ohio, incorporation date, and state of incorporation.

- In the next section, select the corporation/entity type that applies: Domestic For-Profit, Domestic Nonprofit, LLC, Foreign For-Profit, Foreign Nonprofit, or Domestic/Foreign Nonprofit Agricultural Cooperative.

- Choose the dissolution/surrender method required for processing your submission: Certificate of Tax Clearance or Affidavit. Note that Domestic for-profit corporations must select the Certificate of Tax Clearance, while LLCs must choose the Affidavit.

- Indicate the reason for dissolution or surrender, selecting from options such as consolidation, conversion, dissolution/surrender, or merger.

- If applicable, provide details about the converting or merging entity that will continue the business activities, including the entity's name, address, FEIN, Ohio charter/entity number, and the date when the corporation intends to convert or merge.

- Enter the date when Ohio business activities ceased or will cease, and the ending date of the last payroll subject to Ohio withholding.

- Select each tax type applicable to the corporation, providing requested information for each tax type listed, such as the commercial activity tax, consumer use tax, corporate franchise tax, etc.

- Identify the person where the Certificate of Tax Clearance should be sent, ensuring to include their name, title, address, phone, and fax. If this is a representative, include an Ohio TBOR 1 form.

- If different, identify the person for correspondence regarding tax matters with the same information requirements as step 9.

- List each officer's and director's information, including their name, title, home address, and SSN. Use an additional list if necessary.

- Complete the declaration section by signing, indicating the name, title, and date. Make sure that the declaration accurately affirms all conditions and obligations as outlined in the instructions.

- Finally, save your changes, download a copy of the completed form, print it if needed, or share it as required for submission.

Begin filling out your closing documents online today to ensure a seamless submission process.

A closing statement is a document that records the details of a financial transaction. A homebuyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.