Loading

Get 2023 I-030 Wisconsin Schedule Cc, Request For A Closing Certificate For Fiduciaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 I-030 Wisconsin Schedule CC, Request For A Closing Certificate For Fiduciaries online

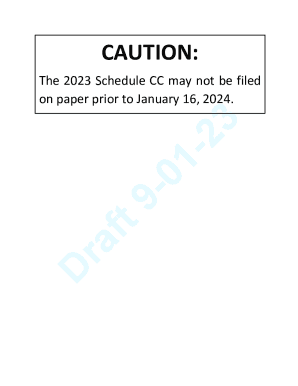

The 2023 I-030 Wisconsin Schedule CC is an important document for fiduciaries seeking a closing certificate for estates or trusts. This guide provides clear and supportive instructions on filling out the form online, ensuring that users with all levels of experience can navigate the process confidently.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the 2023 I-030 Wisconsin Schedule CC. This will allow you to view and utilize the form in your preferred online environment.

- Begin filling out Part I for estates or Part II for trusts, depending on the applicable category. For estates, provide the decedent's last name, first name, middle initial, and social security number. For trusts, enter the legal name of the trust and associated federal EIN.

- Indicate whether a closing certificate is required by the court. If 'Yes', ensure to include documentation that verifies this requirement when submitting your request.

- For estates, answer questions regarding the decedent’s will, tax filings, IRS contact, and residency status in Wisconsin. For trusts, provide information about the trust, including the names and social security numbers of grantors and grantees.

- In both sections, list the total value of probate and non-probate assets. Be sure to provide accurate figures without any commas or cents, as instructed.

- Complete any additional pertinent questions related to fiduciary fees and provide the necessary signatures. Ensure that the document is signed and dated.

- After filling out all relevant sections, review your form for accuracy. You may then save your changes, download, print, or share the completed form as needed.

Complete your documents online with confidence today!

Trusts, or portions of trusts, the assets of which consist of property placed in the trust by a person who is a resident of Wisconsin at the time that the property was placed in the trust if, at the time that the assets were placed in the trust, the trust was irrevocable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.