Loading

Get Nh Dor Nh-1041-es 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DoR NH-1041-ES online

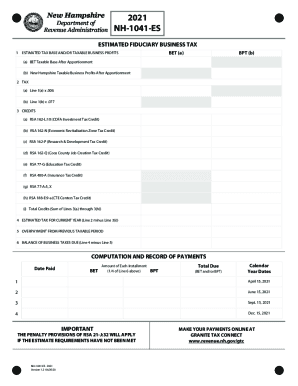

Filling out the NH DoR NH-1041-ES is essential for estimated fiduciary business tax payments in New Hampshire. This guide provides detailed instructions to help users navigate the form seamlessly online.

Follow the steps to complete your NH-1041-ES form online.

- Click the ‘Get Form’ button to obtain the NH-1041-ES form and access it in the online editor.

- Enter the calendar year for which you are filing the estimated fiduciary business tax. Make sure to write the beginning and ending dates as specified.

- Input the taxpayer identification number in the designated field. Do not enter a social security number or federal employer identification number.

- Fill in the name of the estate or trust and complete the address sections including the number and street, city or town, state, and zip code.

- Proceed to calculate the estimated tax base and taxable business profits. Input the required figures into lines 1(a) and 1(b).

- Calculate the estimated tax by multiplying the figures in line 1 by the appropriate rates, and input the results in line 2.

- If applicable, complete the credits section (line 3) by entering the various credit amounts. Sum the credits and record the total in line 3(i).

- Calculate the estimated tax for the current year by subtracting the total credits from the estimated tax (line 4).

- If there is an overpayment from the previous year, enter it in line 5. Use this to determine the balance of business taxes due in line 6.

- Complete the payment form by entering the dates for the installments and the amounts due for each line item provided.

- Finally, review all entries for accuracy, then save your changes or download the completed form. You may also choose to print, share, or submit directly.

Complete your NH DoR NH-1041-ES form online today to ensure timely and accurate tax compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.