Loading

Get In Dor Schedule Ct-40 1998

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR Schedule CT-40 online

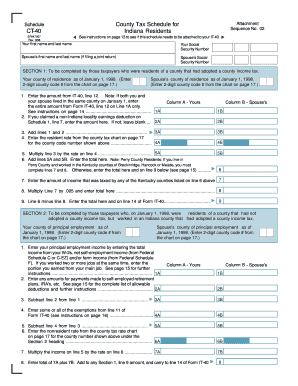

Filling out the IN DoR Schedule CT-40 online can streamline the process of managing your county tax responsibilities in Indiana. This guide will provide you with clear and detailed instructions on how to complete each section of the form effectively.

Follow the steps to complete your county tax schedule online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your first name, last name, and Social Security Number in the designated fields. If you are filing jointly, include your spouse's information as well.

- In Section 1, provide your county of residence as of January 1, 1998, using the 2-digit county code from the chart available. Also, include your spouse's county if applicable.

- Enter the amount from Form IT-40, line 12 on Line 1A. If both you and your spouse resided in the same county, record the total on Line 1A only.

- If you claimed a non-Indiana locality earnings deduction on Schedule 1, line 7, enter that amount on Line 2A; otherwise leave it blank.

- Calculate your total income as directed in each column, ensuring to multiply as required, and enter all computed values accordingly.

- If you reside in Perry County and worked in the specified Kentucky counties, complete lines 7 and 8; otherwise enter your total on line 9.

- Proceed to Section 2 if applicable, entering the relevant information regarding your principal employment income and any deductions.

- After completing all necessary lines and sections, review your entries for accuracy and completeness.

- Save your changes, and choose to download, print, or share the completed form as needed.

Complete your IN DoR Schedule CT-40 online today to ensure timely tax management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

What is IRS Form Schedule 2? Form 1040 Schedule 2 includes two parts: "Tax" and "Other Taxes." Taxpayers who need to complete this form include: High-income taxpayers who owe alternative minimum tax (AMT) Taxpayers who need to repay a portion of a tax credit for the health insurance marketplace.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.