Get Pr Modelo Sc 6042 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Modelo SC 6042 online

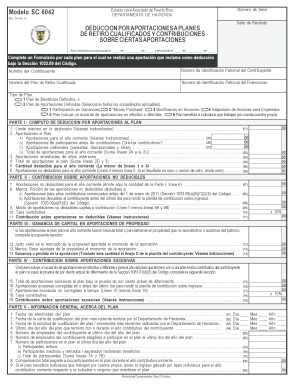

This guide provides comprehensive instructions on filling out the PR Modelo SC 6042, a vital form for individuals claiming deductions on qualified retirement plans in Puerto Rico. By following the steps outlined below, users will be able to complete the form accurately and efficiently.

Follow the steps to effectively complete the PR Modelo SC 6042 online.

- Click the ‘Get Form’ button to access the PR Modelo SC 6042 and open it in your editing interface.

- Fill out the section at the top of the form, providing the tax year, taxpayer's name, taxpayer identification number, retirement plan name, and trust identification number.

- Indicate the type of retirement plan by selecting all applicable options, such as defined benefit plan or defined contribution plan.

- In Part I, compute the deduction for contributions by entering the maximum deductible amount for contributions to retirement plans as specified.

- Record the various contributions made during the current year in the designated lines for current year contributions, pre-tax contributions, and employer contributions.

- Calculate the total contributions for the current year by summing the amounts recorded in the previous lines.

- If applicable, list any carryover contributions from previous years in the provided section.

- Determine the deductible amount for the current year, which is the lesser of the maximum limit or the total contributions.

- In Part II, enter the non-deductible contributions for the current year and calculate any contributions subject to taxation.

- Proceed to Part III if contributions were made in the form of property. Document the fair market value and adjusted basis of the contributed property.

- In Part IV, if applicable, document excessive contributions and determine any required contributions based on those excesses.

- Complete Part V by providing general information about the retirement plan, including effective dates and participant details.

- Review all sections for accuracy and completeness, then save changes, download the form, and print or share as needed.

Complete your PR Modelo SC 6042 online and ensure your retirement contributions are accurately documented.

Get form

Modelo SC 2907 is a specific tax form used for reporting certain types of income in Puerto Rico. It is essential for ensuring compliance with local tax regulations, especially for self-employed individuals and small business owners. When dealing with tax responsibilities, it can be beneficial to integrate the PR Modelo SC 6042 to provide a comprehensive view of your financial situation. Utilizing forms like these on platforms such as uslegalforms can simplify your filing process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.