Get Pr Modelo Sc 4809 From As 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

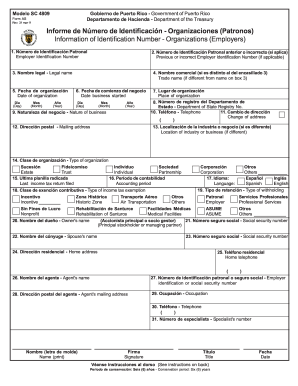

How to fill out the PR Modelo SC 4809 Form AS online

Filling out the PR Modelo SC 4809 Form AS online is an essential step for organizations in Puerto Rico to ensure compliance with tax regulations. This guide provides clear and detailed instructions on completing each section of the form.

Follow the steps to successfully complete the PR Modelo SC 4809 Form AS.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first box, enter your Employer Identification Number as assigned by the Federal Internal Revenue Service. If available, attach a copy of the certification issued by the agency (Form SS-4 or SS-4PR).

- If your Employer Identification Number has changed or if there is a correction, fill out the second box with the previous or incorrect number.

- For the third box, enter the legal name of your organization as it is officially registered. Include a copy of the Certificate of Incorporation issued by the Department of State.

- If your organization operates under a trade name that differs from the legal name in box three, complete the fourth box with the trade name.

- Provide the date of organization in the fifth box, specifying the day, month, and year.

- Indicate the date your business commenced operations in the sixth box, also specifying the day, month, and year.

- Fill in the place of organization in the seventh box.

- In the eighth box, provide your Department of State registry number.

- Enter your contact telephone number in the tenth box.

- If there has been a change of address since your last filing, indicate that in the eleventh box.

- Complete the mailing address in the twelfth box.

- If the location of your industry or business differs from the mailing address, provide this information in the thirteenth box.

- In the fourteenth box, select the type of organization from the provided list.

- Indicate the last income tax return filed in the fifteenth box.

- Specify your accounting period in the sixteenth box.

- Choose the language you prefer for receiving correspondence from the Department of the Treasury in the seventeenth box.

- Complete the eighteenth box by indicating your type of income tax exemption, if applicable.

- In the twentieth box, provide the owner's name.

- Enter the owner’s Social Security number in the twenty-first box.

- If applicable, state your spouse's name in the twenty-second box.

- Indicate your spouse's Social Security number in the twenty-third box.

- Fill out the residential address in the twenty-fourth box.

- Provide your home telephone number in the twenty-fifth box.

- Complete the agent's name in the twenty-sixth box.

- Enter the employer identification number or social security number for the agent in the twenty-seventh box.

- Fill out the agent's mailing address in the twenty-eighth box.

- State the agent's occupation in the twenty-ninth box.

- Provide the agent's telephone number in the thirtieth box.

- If applicable, fill out the specialist’s number in the thirty-first box.

- Finally, sign the form in the signature section, print your name, and enter the date and your title.

- Once all fields are completed, save your changes, download or print the form, and be sure to share or submit it as required.

Complete your forms online to ensure compliance and streamline your document management process.

Get form

Related links form

Form 480.6 C Puerto Rico withholding is used to report and submit tax withholding amounts for payments made to individuals and entities in Puerto Rico. Proper use of this form ensures compliance with tax regulations and accurate reporting of withheld amounts to the IRS. Familiarity with this form can impact your financial outcomes favorably. For more information and guidance, the PR Modelo SC 4809 From AS is a useful resource.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.