Loading

Get Ia Finance Authority Homeownership Program Parameters 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA Finance Authority Homeownership Program Parameters online

This guide provides a step-by-step approach to filling out the IA Finance Authority Homeownership Program Parameters form online. Understanding each section of the form is crucial for ensuring compliance with the program guidelines and enhancing your chances of securing assistance.

Follow the steps to successfully complete the IA Finance Authority Homeownership Program Parameters form.

- Click the ‘Get Form’ button to obtain the IA Finance Authority Homeownership Program Parameters form and open it in the online editor.

- Begin filling out the Personal Information section. Enter your name, contact details, and any associated identifiers required by the program. Be sure to double-check for accuracy.

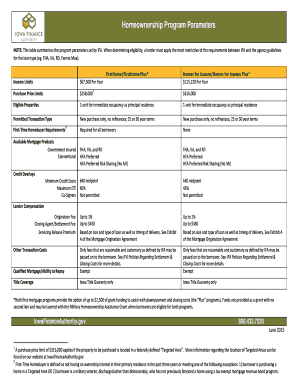

- Next, address the Income Limits. Provide your total annual income, ensuring it aligns with the specified limits for the FirstHome and Homes for Iowans programs.

- Proceed to the Purchase Price Limits section. Input the purchase price of the home, ensuring it does not exceed the maximum limits indicated for the relevant program.

- Fill in the Eligible Properties section. Confirm that the property type meets the eligibility criteria (1-unit for immediate occupancy as a principal residence) and indicate if it is a new purchase.

- Complete the Required Verification Documentation section. Gather and attach necessary documents such as income verification, employment verification, and any applicable purchase agreements.

- If applicable, provide information regarding any co-signers on the mortgage. Ensure that credit overlays and scoring requirements are met as outlined.

- Review your completed form thoroughly. Confirm that all fields are filled accurately and that all necessary documentation has been included.

- Once satisfied with your form, choose to save your changes. You may also have the option to download, print, or share the form depending on the online tool's capabilities.

Take action now and complete your IA Finance Authority Homeownership Program Parameters form online for timely assistance!

GRANT: The down payment assistance grant provides home buyers with a $2,500 grant to assist with down payment and closing costs. LOAN: The 2nd Loan program offers a loan of up to 5% of the home's sale price with no maximum and is repayable at time of sale, refinance or first mortgage paid in full.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.