Loading

Get Oh Dte 23a 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH DTE 23A online

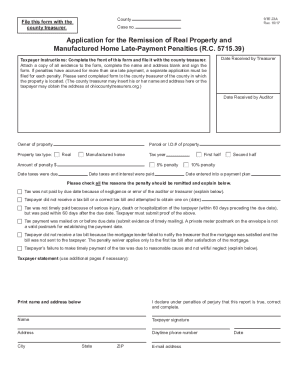

The OH DTE 23A form, officially titled the application for the remission of real property and manufactured home late-payment penalties, is crucial for taxpayers seeking to request relief from penalty fees. This guide will provide you with a clear, step-by-step approach to effectively complete the form online.

Follow the steps to accurately fill out and submit your application.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online editor.

- In the first section, specify your county where the property is located. This is important for ensuring that your form is directed to the correct county treasurer.

- Enter your case number, which is crucial for identifying your application.

- Fill in the parcel or I.D. number of the property. This helps in accurately associating your application with the specific property.

- Complete the owner of the property section with your name and address for proper identification.

- Select the property tax type by checking either ‘Real’ or ‘Manufactured home’.

- Indicate which tax period you are referencing by selecting either ‘First half’ or ‘Second half’.

- Specify the tax year relevant to your application.

- Choose the appropriate penalty percentage that applies to your situation, either ‘5% penalty’ or ‘10% penalty’.

- Input the amount of the penalty incurred.

- Record the due date for your taxes and the date when taxes and interest were paid.

- If applicable, enter the date you entered into a payment plan.

- Check all relevant reasons for requesting the remission of the penalty and provide explanations as needed in the space provided.

- Sign and date the form at the bottom, confirming the information is true and accurate.

- After thoroughly reviewing the completed form, save any changes, download a copy for your records, print, or share the application as needed.

Begin the process of completing your OH DTE 23A form online today.

Related links form

ing to statute, at least one half of a real property tax bill is due by Dec. 31, with the balance due by June 20. In practice, these deadlines are often extended in the ways described below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.