Loading

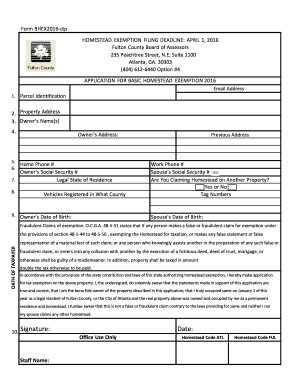

Get Ga Application For Basic Homestead Exemption - Fulton County 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA Application for Basic Homestead Exemption - Fulton County online

Filling out the GA Application for Basic Homestead Exemption allows property owners in Fulton County to apply for tax exemptions. This guide provides step-by-step instructions to ensure you complete the form accurately and effectively online.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the application form and open it in the editing interface.

- In the first section, input the parcel identification number. This uniquely identifies your property for tax purposes.

- Next, enter the property address where the exemption is being claimed, including the street address, city, and zip code.

- Provide the owner's name(s) as they appear on the property title. Ensure correct spelling and formatting.

- Fill in the owner's address, which should match the address listed on any identification documents.

- Add a home phone number where you can be reached for any follow-up regarding the application.

- Enter the owner's Social Security number to verify identity and fulfill legal requirements.

- Indicate the legal state of residence, confirming that the owner resides in Georgia.

- State the county where vehicles are registered, which can be relevant to the exemption process.

- Input the owner’s date of birth, ensuring accuracy to prevent delays in processing.

- Provide the previous address if applicable, this could be needed for verification.

- Fill in the work phone number for any professional inquiries or notifications.

- Include the spouse’s Social Security number if claiming as a married couple.

- Indicate if you are claiming homestead on another property by answering 'Yes' or 'No'.

- List the tag numbers of vehicles registered in your name.

- Input the spouse’s date of birth providing the same level of detail as required for the owner.

- Read the statement regarding fraudulent claims and ensure you understand the implications of misrepresentation.

- In the Oath of Taxpayer section, signify by signing and dating the application, affirming the truthfulness of all provided information.

- Finally, review the entire form for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as necessary.

Take the next step by completing your GA application for basic homestead exemption online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To find out if your GA Application for Basic Homestead Exemption - Fulton County has been approved, you should contact the local tax assessor's office. They can provide status updates and clarify any next steps. Keeping a record of your application submission will help streamline this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.