Get Wi Form F 22541

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wi Form F 22541 online

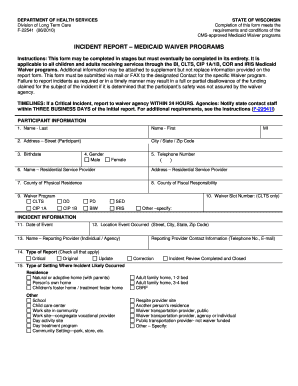

Completing the Wi Form F 22541 online is an essential step for users involved in Medicaid Waiver programs in Wisconsin. This guide provides a clear and supportive walkthrough of the form's components to ensure accurate and timely reporting of incidents.

Follow the steps to accurately complete the Wi Form F 22541 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by filling out the participant information section. Enter the participant's last and first name, address (street, city, state, zip code), birthdate, gender, and telephone number. Additionally, include the name and address of the residential service provider, the county of physical residence, county of fiscal responsibility, and the waiver program being utilized.

- Proceed to the incident information section. Fill in the date of the event and the location where the incident occurred, including the street address, city, state, and zip code. Record the name of the reporting provider, and check the type of report being submitted (critical, original, update, correction, etc.).

- In the type of setting section, indicate where the incident most likely occurred by checking the appropriate boxes or providing additional information as specified.

- Complete the event/allegation checklist by marking applicable event types or allegations. If there is uncertainty regarding an event, select 'Alleged Only'. Provide a brief description of the incident and the actions taken to resolve it while ensuring the participant's health and safety.

- If applicable, enter the date of death and the official cause of death reported on the death certificate.

- Fill out the contact/supplemental reporting checklist by marking all persons or agencies contacted by the county waiver agency.

- Next, provide details about the caregiver involved in the incident, including their name, employer, and address.

- Conclude the form by describing significant actions taken following the incident, changes to the participant’s situation, and the type of action taken by the county or waiver agency. Complete the notification of incident section by entering relevant dates and identifying the original reporter.

- Finally, fill out the person completing the form information, including their name, title, agency, email address, and telephone number. If applicable, also complete contact information for the support and service coordinator or independent consultant.

- Once all sections are completed, save any changes made to the form online. You can download, print, or share the completed form as needed.

Start filling out the Wi Form F 22541 online today to ensure compliance with Medicaid Waiver program requirements.

Yes, Wisconsin sales tax exemption forms can expire depending on the specific type and usage. Generally, forms should be regularly updated to reflect current status and eligibility. Staying informed on when to renew your exemption forms ensures compliance and avoids unnecessary tax charges. For assistance with navigating these forms, the Wi Form F 22541 can serve as an essential resource to guide you through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.