Loading

Get Ma T20045 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA T20045 online

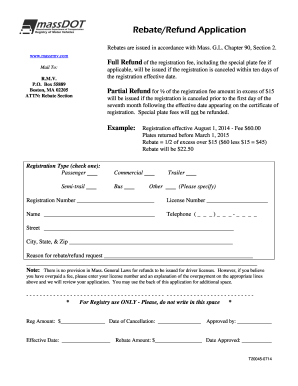

The MA T20045 is a rebate and refund application that allows users to request a full or partial refund of their vehicle registration fees. This guide will provide clear steps to help you fill out the form accurately and efficiently.

Follow the steps to complete your rebate/refund application.

- Click the ‘Get Form’ button to obtain the form and access it for completion.

- Select your registration type by checking the appropriate box (Passenger, Semi-trailer, Commercial, Bus, Trailer, or Other). Provide details in the specified fields.

- Fill in the registration number and license number in the designated spaces to identify your vehicle and registration.

- Enter your name, along with a valid telephone number where you can be reached.

- Complete your address by filling in the street, city, state, and zip code fields to ensure accurate processing of your application.

- Provide a reason for your rebate or refund request in the space provided—this should include details about the cancellation or overpayment.

- If you are requesting a review for an overpayment of a driver's license fee, enter your license number and a brief explanation in the designated fields.

- Once all necessary information is filled in, review your application for accuracy before saving it.

- Finally, save your changes, then download, print, or share the form as needed for submission.

Complete your MA T20045 online today for a smooth rebate or refund process.

Related links form

To file Massachusetts sales tax, you need to register for a sales tax account. After registration, you will file your returns regularly, detailing your sales. While this differs from estate tax matters, understanding forms like MA T20045 can enhance your overall tax filing knowledge.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.