Loading

Get Alabama Form 96

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Form 96 online

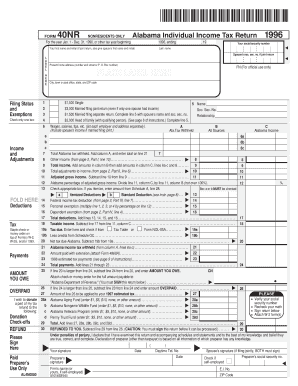

Filling out the Alabama Form 96 online can streamline your tax filing process, ensuring that you complete your individual income tax return efficiently. This guide provides step-by-step instructions to help users navigate the form with ease, whether you have prior tax filing experience or not.

Follow the steps to successfully complete the Alabama Form 96

- Click ‘Get Form’ button to obtain the form and open it in the online editing tool.

- Begin by entering your personal information at the top of the form. This includes your first name, last name, and social security number. If filing jointly, include your partner's information as well.

- Select your filing status by checking the appropriate box in the 'Filing Status and Exemptions' section. Options include single, married filing jointly, married filing separately, and head of family.

- In the income section, report your wages, salaries, tips, and other income sources. Be sure to list this information clearly for each employer and relevant source.

- Proceed to enter all relevant deductions and adjustments to income. Follow the instructions closely to ensure accurate calculation of your taxable income.

- Complete the tax computation by referencing the Alabama tax tables or special forms like the NOL-85A, if applicable.

- In the payments section, enter any Alabama income tax withheld, estimated tax payments, and any other amounts relevant to your tax situation.

- If applicable, make any donations to specified funds directly on the form, indicating the amount clearly.

- Before finalizing the form, double-check your entries for accuracy. Verify that all calculations are correct and all necessary fields are completed.

- Once you are satisfied with the information provided, you can save your changes, then download, print, or share the completed form as necessary.

Complete your Alabama Form 96 online today to ensure a smooth and efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To contact Alabama state taxes, you can reach out to the Alabama Department of Revenue through their website or customer service line. They offer several contact options, including phone and email, for your convenience. If you have specific questions regarding Alabama Form 96, they can provide detailed assistance to ensure you understand your requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.