Loading

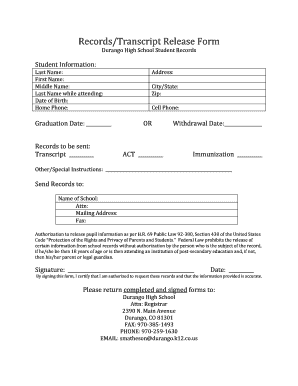

Get Co Durango High School Records/transcript Release Form 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO Durango High School Records/Transcript Release Form online

Filling out the CO Durango High School Records/Transcript Release Form online is a straightforward process that requires careful attention to detail. This guide provides step-by-step instructions to help you easily navigate the form and ensure that all necessary information is accurately submitted.

Follow the steps to properly complete the form.

- Press the ‘Get Form’ button to access the Records/Transcript Release Form and open it for editing.

- In the 'Student Information' section, fill in the following fields: Last Name, First Name, Middle Name, Last Name while attending, Date of Birth, and Home Phone. Make sure to provide accurate information to avoid any delays.

- Indicate your graduation date and specify which records you would like to be sent. You may choose to receive either your Transcript or ACT scores, and also provide details on your Withdrawal Date and Immunization records if needed.

- Complete the 'Send Records to' section by entering the Name of School, the Attn (attention) line if applicable, and the Mailing Address along with the City/State and Zip code. If there is a Fax number where records should be sent, include that as well.

- In the 'Authorization to release pupil information' section, read through the legal statement and understand your rights regarding personal information. By signing the form, you confirm that you are authorized to request these records.

- At the end of the form, provide your signature and date. By doing this, you certify that the information you provided is accurate and that you have the authority to request the records.

- Once you have completed and signed the form, save your changes. You can then download, print, or share the completed document as needed.

Complete your Records/Transcript Release Form online now for a smooth and efficient process.

Related links form

TAX LIENS AND PERSONAL LIABILITY. Sec. 32.01. TAX LIEN. (a) On January 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.