Loading

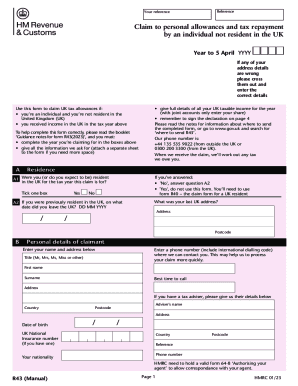

Get R43(manual). Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The Uk

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R43(Manual). Claim To Personal Allowances And Tax Repayment By An Individual Not Resident In The UK online

This guide provides a clear and comprehensive overview of filling out the R43(Manual) form for claiming personal allowances and tax repayment as a non-resident individual in the UK. Follow these instructions to ensure your submission is accurate and complete.

Follow the steps to successfully complete the R43 form online.

- Press the ‘Get Form’ button to obtain the R43(Manual) form and open it in your chosen editor.

- Begin by completing the year you are claiming for in the specified boxes near the top of the form. Ensure this reflects the correct tax year ending on April 5 of the relevant year.

- Answer the residence questions in section A. Indicate whether you were or expect to be resident in the UK during the tax year by ticking the appropriate box.

- If you selected 'No' in A1, provide the date you left the UK and your last UK address in section A2.

- In section B, fill in your personal details, including your name, address, and contact information. If you have a tax adviser, provide their information as well.

- In section C, declare your income from the UK. Include all dividends, interest, rental income, pensions, benefits, and any other relevant income, ensuring accuracy in the amounts reported.

- Complete section F to claim any eligible tax allowances by ticking the appropriate boxes and providing necessary details, such as spouse information for Married Couple's Allowance.

- In section G, specify how you would like to receive any tax repayment, either directly or through a nominee, and provide the relevant information.

- Finally, read the instructions provided in section H carefully. Sign and date the form, then print your name in capital letters to complete your submission.

- Once you have filled out all sections accurately, you may save changes, download, print, or share the completed form as needed.

Start your filling process online today to ensure you receive the tax allowances and repayments you may be entitled to.

Related links form

You can claim back tax and personal allowances as a UK non-resident on any UK income you receive in the current tax year or in the last 4 tax years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.