Loading

Get Ny Form It-203-x 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Form IT-203-X online

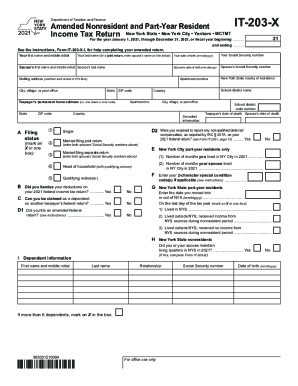

Filling out the NY Form IT-203-X online can be a straightforward process when you follow clear guidance. This amended nonresident and part-year resident income tax return allows users to update previous filings and ensure accuracy in reporting income and deductions.

Follow the steps to effectively complete your NY Form IT-203-X.

- Click ‘Get Form’ button to obtain the IT-203-X and open it in your preferred editing tool.

- Start with your last name and date of birth, filling in each field accurately. For a joint return, include your partner’s name and their date of birth in the designated spaces.

- Complete the mailing address section with your current address. Ensure all information is current and reflects your location.

- Mark your filing status by selecting one box: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- For part-year residents or nonresidents, enter the expected details about your living situation in New York State during the tax year.

- In the income section, accurately report all your income sources using the appropriate lines for wages, dividends, refunds, and other earnings.

- Calculate your New York adjusted gross income by following the instructions for additions and subtractions specific to your situation.

- Proceed to determine your deductions. Based on your filing status, enter the standard deduction or itemized deductions accordingly.

- Complete the tax computation section to determine any credits and taxes owed based on your reported income.

- Fill in the payment and credit section to indicate any taxes withheld and refundable credits applicable to your return.

- Indicate your refund preference or any amount owed, ensuring to provide accurate banking information if requesting direct deposit.

- Review all entered details for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Start filling out your NY Form IT-203-X online to ensure your tax records are accurate.

You must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, if you: were not a resident of New York State and received income during the tax year from New York State sources, or. moved into or out of New York State during the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.