Loading

Get Where To File Addresses For Taxpayers And Tax Professionals

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Where To File Addresses For Taxpayers And Tax Professionals online

Filing the Where To File Addresses For Taxpayers And Tax Professionals form is essential for ensuring accurate tax submissions. This guide provides clear instructions to help users navigate the form effectively and submit their information without errors.

Follow the steps to successfully complete the form.

- Use the 'Get Form' button to access the form and open it in your editing software.

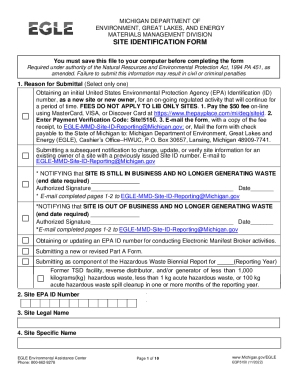

- Begin by selecting the appropriate reason for submission from the options provided. Carefully read through each option to ensure you select the correct one that applies to your situation.

- Enter the Site EPA ID Number. This is a crucial part of the form, as it links your submission to your specific site.

- Fill out the Site Legal Name and Site Specific Name. Ensure that the names are accurate and correspond to your official business records.

- Complete the Site Location Address section, where you will provide the street address, city or town, county, state, country, and zip code for your site.

- If your mailing address is different from your location address, fill out the Site Mailing Address section with the necessary details.

- Input the Federal Tax ID number, which is required for tax identification purposes.

- Indicate the Site Land Type by checking the relevant box that describes the land type.

- Enter at least one North American Industry Classification System (NAICS) code applicable to your business. This code is required for classification purposes.

- Provide Site Contact Information, including the first and last name, title, address, email, and phone number for the person responsible for communication.

- Fill out the legal owner and operator details, including changes if applicable, ensuring that all contact information is current.

- Complete the section on Hazardous Waste Activities, answering all questions to provide a clear report on your waste management activities.

- After completing the form, review all entries for accuracy. Once verified, you can save your changes, download the form, print it for your records, or share it as required.

Start completing your documents online today to ensure timely submissions!

In fact, Realtors are real estate agents. The difference is that Realtors join the National Association of Realtors (NAR), which holds them to a higher standard of ethics than real estate agents must abide by”. According to the NAR, about half of all real estate agents in the United States are certified Realtors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.