Loading

Get Application For Entitlement To Reduced Tax Rate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Entitlement To Reduced Tax Rate online

Filling out the Application For Entitlement To Reduced Tax Rate can be a straightforward process when following the right steps. This guide provides clear instructions to help you navigate the form and ensure accurate completion.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

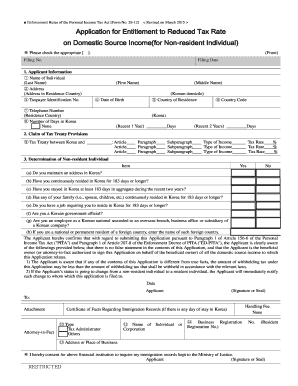

- Fill in the filing number and date in the respective fields. This information is typically assigned by the tax agent receiving the application.

- In the Applicant Information section, provide your full name as it appears on your passport in the designated fields for last name, first name, and middle name.

- Enter your address in your country of residence. Make sure to write it in English and in the order of street number, street name, city, state, postal code, and country.

- Input your taxpayer identification number, which varies based on your residence status. Follow the guidelines provided in the form to select the correct number classification.

- Specify your date of birth, ensuring it is formatted correctly.

- Provide your country of residence and its associated code from the ISO country codes.

- Enter your current telephone number, including the country code.

- Indicate the number of days you have stayed in Korea over the past year and the past two years, checking 'None' if applicable.

- In the Claim of Tax Treaty Provisions section, detail the tax treaty between Korea and your country of residence, including the relevant articles and the tax rates applicable to your income.

- Respond to the questions in the Determination of Non-resident Individual section. Answer 'Yes' or 'No' based on your situation, as this will affect your tax status.

- Read and acknowledge the confirmation statement about the accuracy of your application. This may require your signature or seal.

- Attach any necessary documents, such as the Certificate of Facts Regarding Immigration Records, if required.

- Review your entries for accuracy and completeness before saving or downloading the filled form.

Complete your application online today to benefit from the reduced tax rate.

Special tax exemptions for SMEs The tax deduction ratio ranges from 5% to 30%, depending on corporate location, size, business types, etc., with a cap of KRW 100 million. This incentive is applied to taxable income arising in the tax years that end before 31 December 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.